Everything must be awesome, right!!!

This 5-day run is even bigger than the ramp off the October 2014 Bullard lows…

This is the biggest 2-day short-squeeze since October 2011 (the last time the market squeezed like this was after the Black Monday plunge… which saw new lows hit)

Volume was abysmal…

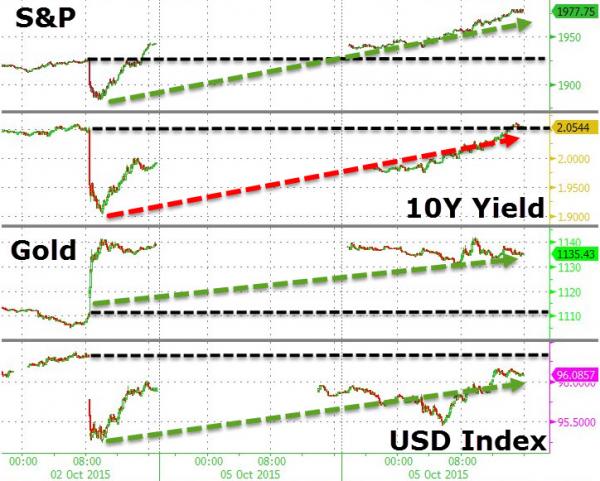

Across asset classes since Payrolls…

* * *

Off Friday’s lows, the move in stocks is epic…

On the day, cash indices surged again… (note that S&P remains just shy of the 50-day moving average at 2000.25).

But The Dow rallied back to its 50DMA…

As VIX was clubbed like a baby seal…5th day in a row… (biggest 5 day drop since mid July)

As USDJPY did the heavy-lifting..Spot The Difference…

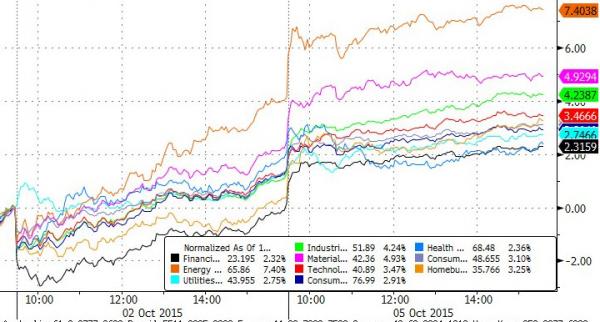

Energy was the best-performing sector (most squeezed) as crude surged…

Notably, financial stocks bounce is entirely decoupled from credit markets…

While the broad credit market rallied, No deals priced in the high-yield market on Monday.

The primary market has been shut since September 25. Meanwhile spreads continue to widen. The average high-yield bond spread hit a new 2015 high of T+683bp.

The average spreads on Double B, Single “B” and Triple “C” rated credits hit new 2015 highs of T+477bp, T+700bp and T+1323bp, respectively. The high-grade and high-yield average spread differential hit a new 2015 high of 503bp.

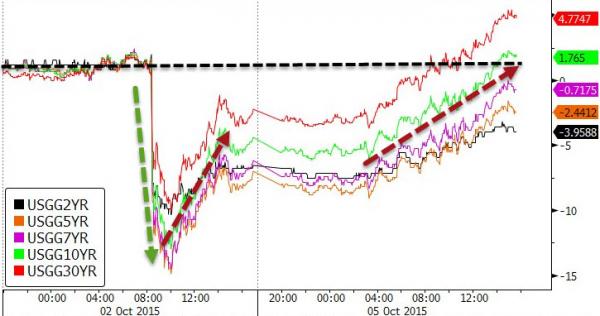

Treasury yields continued to spike all day…

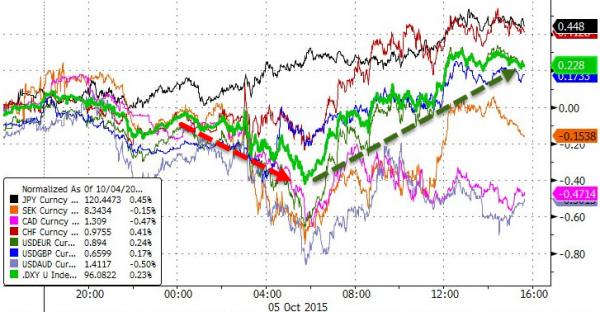

The USD was heavily bid during the US session after weakness again overnight…

Silver has been the biggest winner post-payrolls as Gold, Copper and Crude are all clustered around the same gains…

Charts: Bloomberg

Leave A Comment