Expectations for today’s Bank of Canada rate decision are low – consensus expects rates to be maintained at 1%. Thus the real driver for the currency will be in the Bank’s statement. Last October, the BoC said that the “Governing Council will be cautious in making future adjustments in the policy rate”. Markets focused on the word “cautious”, believing that the outlook for further hikes in 2017 was limited. The Canadian dollar weakened as a result. Looking at rate hike expectations, the odds for a January 2018 rate hike are about 40% today. Thus the market will be looking for suggestions that a future rate hike is in the cards from today’s statement.

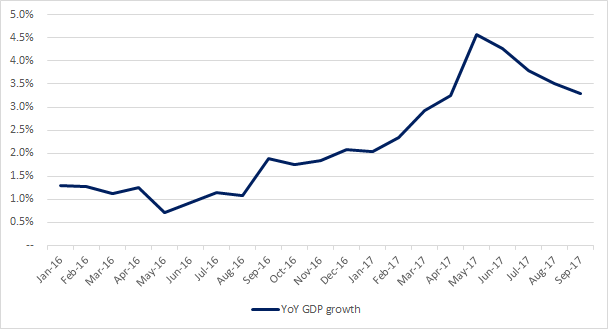

Growth remains higher than expectations, but headed in the wrong direction

Last week, the Canadian dollar strengthened after GDP growth estimates were higher than consensus expectations. Looking at quarter-over-quarter annualized numbers, growth came in at 1.7% (versus expectations of 1.6%). The picture from unemployment was even better, with the unemployment rate falling to 5.9% (versus expectations of 6.2%). Unlike other natural resource-heavy economies such as Australia, the Canadian consumer story still looks bright. While GDP growth beat expectations, the economy is still slowing in rate-of-change terms. This is shown below:

After peaking in the summer, downhill from here

Source: Statistics Canada

While year-over-year growth clocked in at 3.3%, an impressive figure, GDP growth is set to continue slowing in 2018. Growth is likely to be weighed down by the issues of base effects (mathematically, delivering growth gets tougher next year) and slower government spending (the Liberal government’s stimulus program is unlikely to keep growing in size). While consumer and business spending remain strong, the Bank of Canada is not likely to turn hawkish when GDP growth is weakening.

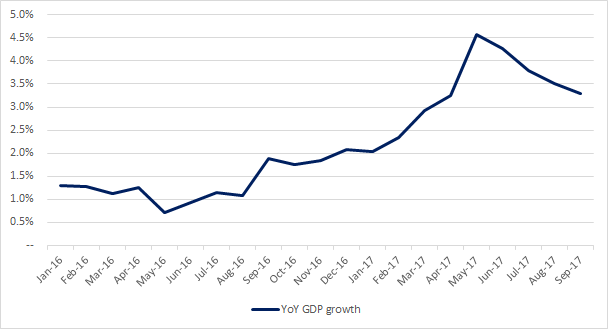

Inflation also below target

While headline inflation has improved recently, cost pressures remain significantly below the Bank of Canada’s target. This is shown below:

Leave A Comment