S&P futures are little changed following yesterday’s rout even as Asian and European markets continued selling; the pound slid on poor factory data, the yen tumbled after the BOJ intervened to stabilize the JGB bond market, precious metals flash crashed early in the session, while the sell-off in oil accelerated despite yesterday’s massive inventory draw, although at least yesterday’s sharp bond tantrum has stabilized.

MSCI’s gauge of global stocks was at its lowest since late May’s record highs and down 0.6% for the week. Global stocks are poised to end the week at six-week lows in the face of oil weakness, a spike in bond yields and anticipation of tighter monetary policy, particularly in the United States. Concerns that the world’s central banks are moving closer to unwinding ultra-loose monetary policies have roiled markets and ECB minutes released on Wednesday indicate its policymakers are open to further steps. This sent German government bond yields to 18-month highs, lifted the euro and weighed on stocks.”Once again, bond markets are ruling FX and having an increasing impact on equity markets,” strategists at Morgan Stanley, led by Hans Redeker, said, drawing parallels with moves seen in 2013 during the so-called “taper tantrum,” when Fed signals about withdrawing liquidity hit markets.

The dollar rose against a basket of major currencies and hit a seven-week high against the yen after the Bank of Japan increased its government bond buying, expanding monetary policy when other central banks are moving towards tightening. Despite Thursday’s massive DOE inventory draw, oil was unable to sustain gains and Brent dropped to $47.26.

S&P futures held steady as investors await the June jobs report and the first official meeting between Donald Trump and Vladimir Putin.S&P futures traded at 2,410 after the cash index dropped to a a six-week low on Thursday, when real estate stocks had their biggest daily drop in 2017. Both Dow Jones and Nasdaq 100 futures are also little changed.

Looking at Asia, the yen fell sharply and JGB yields pulled back from five-month highs after the BOJ announced its first unlimited fixed-rate bond purchases since February. As discussed last night, this morning the BoJ offered to buy unlimited fixed-rate purchases for the first time since February to cap the move, offering specifically to buy 10y bonds at 0.110%. While no bids were subsequently tendered, the offer has resulted in yields dropping as low as 0.081%. It’s worth noting that this is the third time that the BoJ has flexed its muscles in controlling the yield curve since introducing the policy in September.

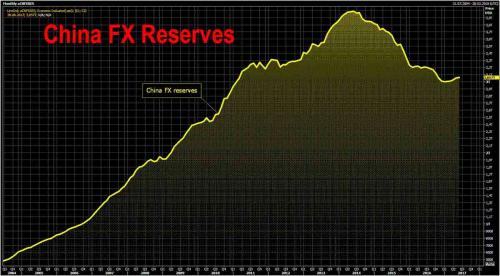

The JGB 10s30s re-approaches steepest levels YTD in reaction. Despite the BOJ intervention, Australian sovereign bonds were under heavy selling pressure with the 10-year yield jumping as much as ten basis points to 2.736%; shares in Sydney 1% lower. In China the 7-day repo rate fell seven basis points despite PBOC skipping liquidity operations for eleventh session and draining a whopping CNY 750 billion over the same period; the onshore yuan little was changed. Overnight, China reported that its FX reserves rose for the 5th month in a row, rising another $3bn in June to $3.057TN, however the increase was driven mostly by non-USD currency appreciation.

European stocks fell even as the Utilities sector supported risk with Centrica up 4.4% following reported M&A interest. German 10-year Bund yields climbing to an 18-month high as Treasuries also slipped modestly, both rising by 1bp. Italian BTPs underperform due to bond exchange operation increasing duration.

The Euro continued its upward move while sterling dropped sharply below 1.29 after U.K. May industrial and construction outputs both dropped, missing an expected increase; core bonds opened steady after yesterday’s sharp technical driven sell-off

A quick preview of today’s payrolls report courtesy of Deutsche Bank (a detailed breakdown can be found here):

Looking ahead to payrolls then, following the low 138k print in May the consensus for June is currently sitting at 178k. Our US economists expect a slightly more meaningful rebound to 210k which would be likely sufficient to keep the unemployment rate steady at 4.3% assuming a slight nudge up in the participation rate. Yesterday’s ADP print (158k vs. 188k expected) was a little less than what the market had expected (and included 33k of downward revisions) however it’s worth noting that the employment components in both of the ISM’s this week have been overall fairly solid (57.2 for themanufacturing sector and 55.8 for the services sector) and also that the ADP hasn’t necessarily been the best predictor of payrolls in recent months. As always also keep an eye on other elements of thereport including average hourly earnings (+0.3% mom expected).

In Rates, German 10-year yields climbed one basis point to 0.57 percent as of 10:50 a.m. in London after rising 9 basis points on Thursday. The yield on 10-year Treasuries added one basis point to 2.38 percent, after climbing four basis points on Thursday. Yields in the Bloomberg USD Emerging Market Sovereign Bond Index advanced 17 basis points to 4.81 percent this week, the most since the week ending Nov. 18. EM sovereign dollar bonds posted their worst week since November.

In commodity markets, Brent crude futures, the international benchmark for oil prices, were trading down 1.2 percent, at $47.55 per barrel. Oil prices are down more than 16 percent this year, muddying the outlook for inflation expectations globally.WTI crude slips below $45 on rising output: West Texas Intermediate tumbled 2.5% to $44.38 a barrel, more than erasing Thursday’s 0.9 percent gain. Oil is down 3.6 percent for the week as a decline in U.S. stockpiles failed to convince investors that global markets are rebalancing. Gold slipped 0.3% to 1,221.62 an ounce. The precious metal is down 1.6 percent for the week, its worst performance since early May. Dalian iron ore erases early loss to trade 1.1% stronger

Leave A Comment