pic.twitter.com/g4EjXXJofL

— StockCats (@StockCats) October 19, 2017

Saved…”

NOTE: Before we start – something went very funky in the last couple of minutes of the market today – TRUMP SAID TO BE LEANING TOWARD POWELL FOR FED CHAIR: POLITICO – a Dovish pick…

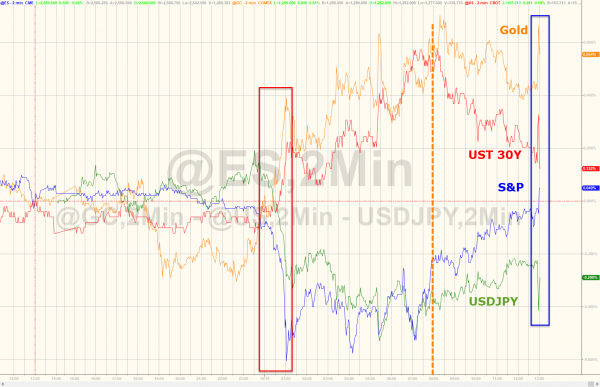

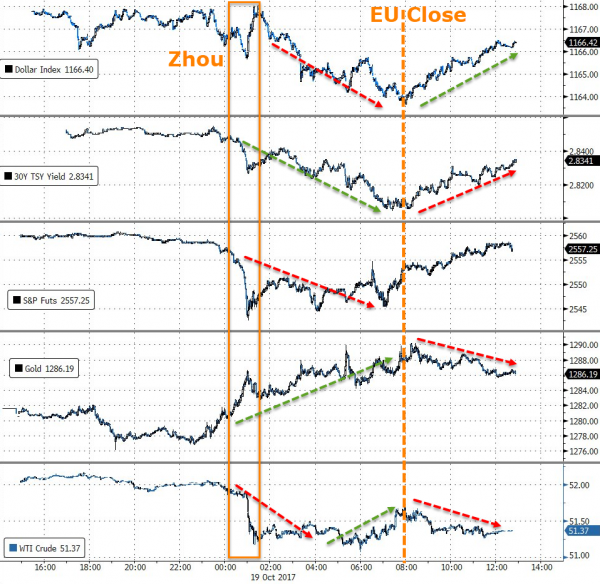

For a brief moment there this morning, some reality poked its head out of the cave after PBOC’s Zhou raised fears of asset bubbles needing to be controlled, Hong Kong stocks crashed, Spain appeared to invoke Article 155, and AAPL slid on sales concerns… but that did not last long as commission-takers reminded the machines that 1987 can never happen again.. ever.. and that every dip is beholden to be bid…

Small Caps and Nasdaq remain red on the week as The Dow pushes on…

Once US equity markets were open for action – risk-off became risk on…

Everything the same…

VIX briefly spiked above (drum roll pls) 11 before being beaten back once again…

#Volatility is currently at 10, on #BlackMonday it was 150…my how times have changed.

— Rick Rieder (@RickRieder) October 19, 2017

The decoupling remains…

Tech stocks tanked today (FANGs and AAPL leading the way) but did not bounce like the main indices…

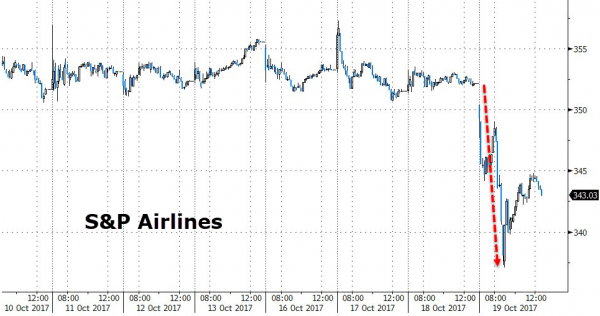

Trannies tumbled early, driven by a plunge in airlines (but even that was bid)

United shares fell as much as 12 percent, which would be the biggest drop since October 2009 on a closing basis, after the airline’s profit outlook disappointed investors. UAL’s forecast for a pretax profit margin of no more than 5 percent this quarter means it will fall further behind industry leader Delta, according to JPMorgan.

Healthcare stocks extended their gains – despite no deal..

Financials were the big dip that was bought…

Treasury yields were all lower (and the curve flatter) on the day…something seems to be happening between the close of Asia and the close of Europe…

Leave A Comment