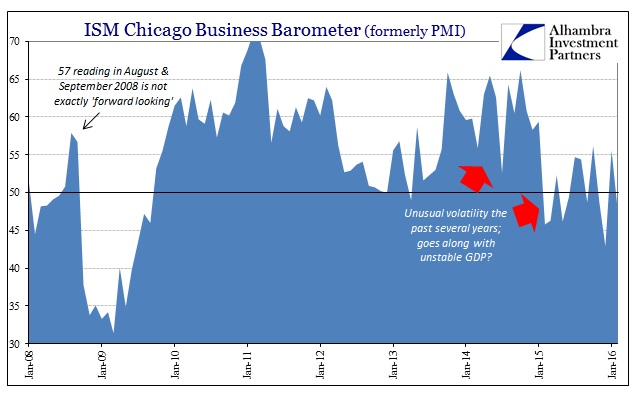

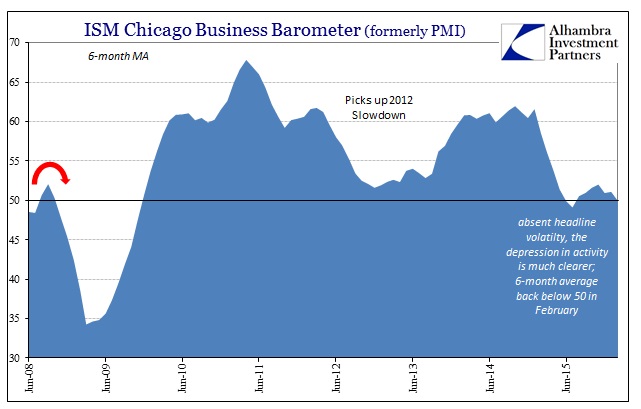

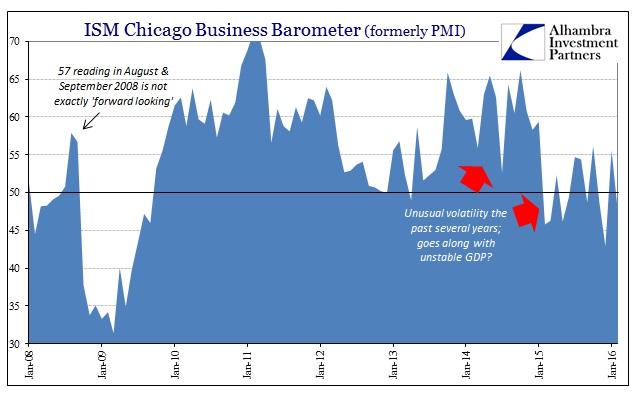

The Chicago Business Barometer fell sharply again in February, almost exactly as it had risen sharply in January. In fact, for the past year that has been the dominant pattern of sharp alternating swings between “growth” and “contraction.” Despite that, months showing up below 50 (this is still a PMI) are still somehow “unexpected”:

Chicago-area business activity unexpectedly contracted in the month of February, according to a report released by MNI Indicators on Monday…

Economists had expected the index to drop to 53.0, although a reading above 50 would have indicated continued growth.

As with all PMI’s, the actual reading is far less significant than the overall trend. That seems to be these wild swings anchored around the 50 mark. Volatility in economic accounts like this tends to suggest increased uncertainty, which would fit this overall environment. Fromthe press release:

The Barometer’s decline was led by an 18.5 drop in Production, which completely reversed January’s near 16 point gain, pushing it back into contraction. New Orders also fell sharply and Order Backlogs slipped further into contraction, a situation that has persisted for a year. Employment also declined significantly, leaving it at the lowest since November 2009 and the fifth consecutive month below 50.

In other words, serious decay inside the report but ambiguously so (especially to the mainstream that still holds on to the recovery narrative) given the comparison to much better January. These large monthly variations actually predate 2015, having shown up in the middle of 2013 and then intensifying in 2014. That, too, fits the overall environment under increasingly uncertain financial conditions (“dollar”) that are playing havoc with any number of accounts and estimates, including GDP it would seem.

In other words, economic and volatility in 2013 and 2014 has remained just as volatile and uncertain, only now more depressed. The interpretation of that peculiar trend might account for another seeming economic anomaly, that of the very slow downward overall trajectory. This “cycle” is unlike anything seen before, as recessions usually develop quickly over several months at most; the Chicago BB was 66.2 in October 2014 right along with +4% GDP. None of that was meaningful, however, in terms of the future economic course which not long thereafter “unexpectedly” sunk into at least a “manufacturing recession” that continues to somehow linger.

Leave A Comment