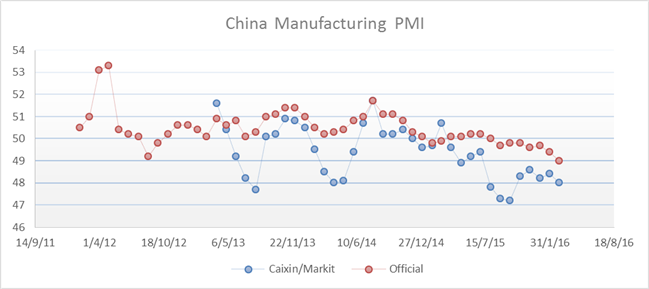

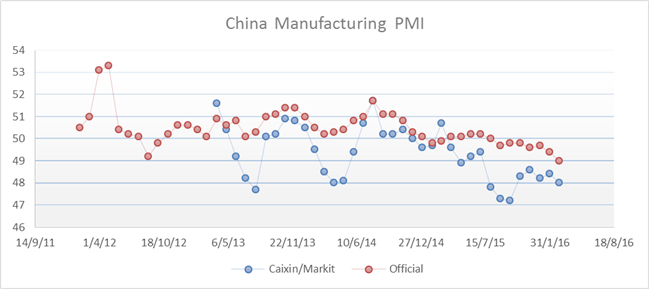

China manufacturing purchasing manager index (PMI) data from both Markit and National Bureau of Statistics were consistent to a down trend. Both missed expectations and also lowered from the previous month.

Chart by author. Data by Markit & China’s NBS via Bloomberg

This did not ring well for copper price which may finish as the worst performer among commodities today. Copper so far lost around 1.3 percent on both Comex and Shanghai Futures Exchange. Factory growth in China indirectly determines demand for industrial metals, therefore a slump within already falling series signal at deeper concerns.

China’s required-reserve-ratio (RRR) cut last night did not appear to alleviate market’s woes. This 5th cut since February 2015 aimed to loosen credit condition and boost business lending.

Oil price elevated near $34 on news of falling production from both the U.S. Energy Information Administration and OPEC. US shale output in December fell for a third month, to the lowest since November 2014. A Reuters’ survey highlighted OPEC output also dropped in February from its highest monthly level, likely due to pipeline interruption in Kurdistan. These are short term optimism however.

Gold price rallied for a second day and haven assets leveraged on the growing uncertainty from China. The mixed bag of weak growth indicators and constant stimulus actions do not bode well for market confidence. As March commences, gold still retains an upside bias prior to US Non-farm Payrolls data later this week and central banks meeting in the month.

GOLD TECHNICAL ANALYSIS – Gold price rallied for a second day and moving averages aligned to uptrend signal. Immediate resistance level is 1263, a daily high on February 11. Support trend line firmly holds on the downside.

Daily Chart – Created Using FXCM Marketscope

COPPER TECHNICAL ANALYSIS – Copper price traded flat under 2.1485 resistance level as momentum hints at consistently downward pressure. However on the downside price stays clear of previous daily lows around 2.06. A consolidation period is emerging.

Leave A Comment