There will always be demand for silver (NYSE: SLV) because aside from silver being a precious metal, it also has many industrial and technological applications. Therefore, there will always be some level of demand, but such demand has risen significantly as the economy has escaped the Great Recession.

Demand for silver is not just in things like coins and bullion. The demand comes from many other sources such as jewelry, silverware, and dentistry. On the technology front, silver is a key component and is used in electronic devices, optics, medical devices/tools and most recently, in nanotechnology. From an anecdotal standpoint, think of the demand in computing in the last few years, especially as supercomputers attempt to mine bitcoin. Many businesses are investing in supercomputers to mine bitcoin, and as such, this raises demand for silver in technology.

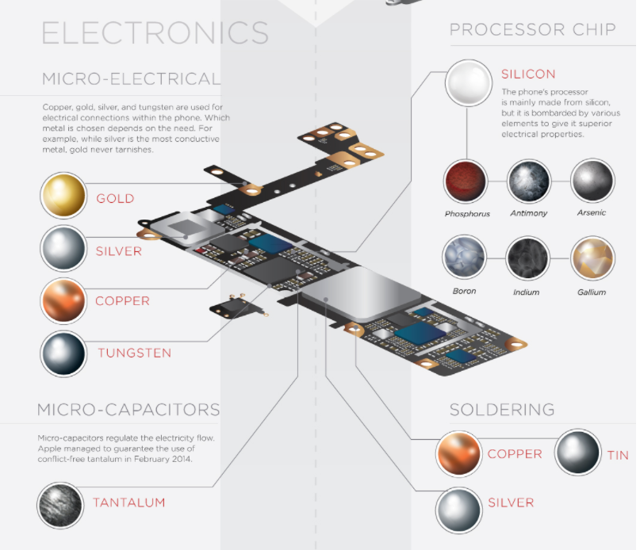

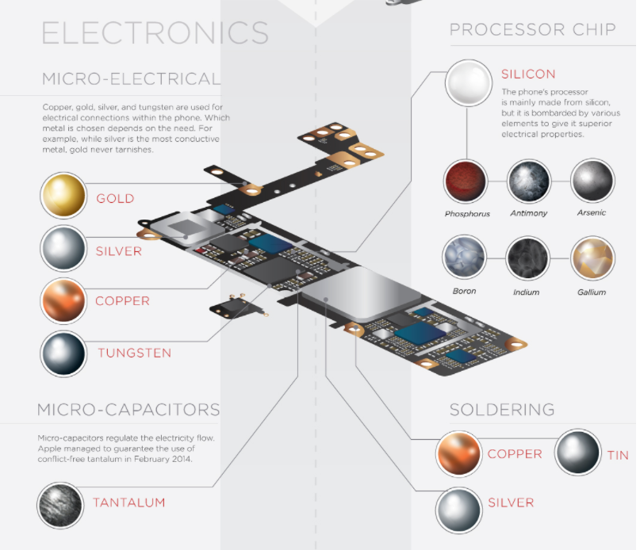

The biggest growth area for silver use, besides being a precious metal currency, is in technology. This is not just a cryptocurrency-related demand. A lot of demand comes from Apple (Nasdaq: AAPL) iPhones, iPads etc., and its competitors’ similar products. Apple alone has created massive industrial demand for precious metals. Here is a look at what is inside just the processing chips in modern iPhones:

Source: Mining.com

Gold, as well as silver, is utilized heavily in these high-tech devices. On average, about $0.19 of silver is now used in each cell phone. That is impressive when we scale up. While that is not much for a single phone, considering there were over 5 billion mobile subscribers worldwide in 2017, a number that’s growing, it becomes clear that new phones will always be in demand.

Using the average of 19 cents a phone, we generate demand for nearly $1 billion worth of silver in just new mobile devices alone if every one of these 5 billion subscribers replaces their phone just once. What is more, little of this silver is ever recovered from technology.

Leave A Comment