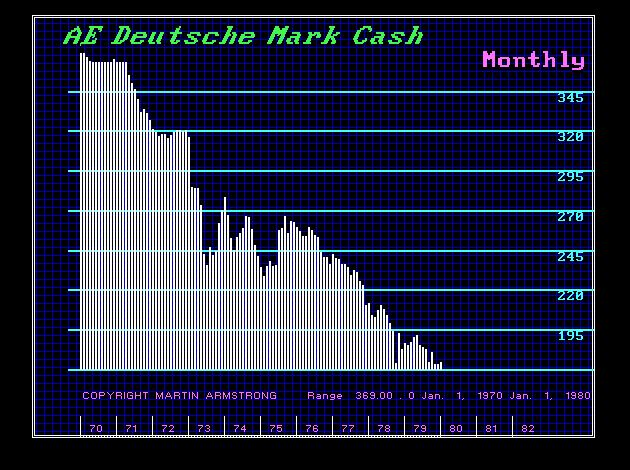

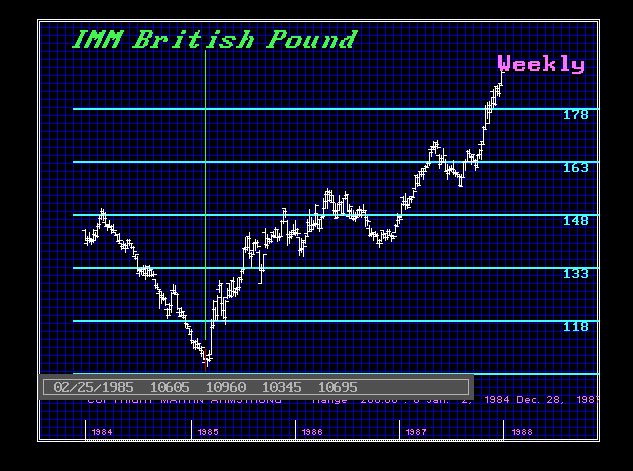

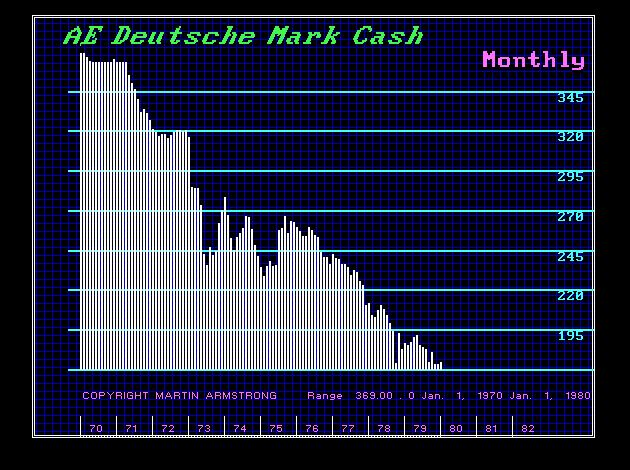

The decline in the dollar throughout the 1970s made German cars appear to appreciate and this was attributed to quality. This was the entire reason why the German car industry exploded. I have often stated at WEC conferences that I made the same play with a Ferarri in London. When the British pound dropped to $1.03 in 1985, I ran out and used the currency to make some deals. I bought a 328 Ferarri for about $30,000 when in the US it was a $50,000 car. Because the pound had dropped, Ferarri could not afford to sell them in Britain at that price so they raised it £45,000.

As you can see from the chart I provided, the pound bottomed in February 1985 at $1.0345. After Ferrari raised the price and then the pound went to nearly $2, suddenly a car that cost me $30,000 had a replacement cost of almost $100,o00. This is what led to many people buying several Ferraris and garaging them thinking that the car was the investment.

Currency Inflation is probably the most misunderstood economic force in the matrix. Probably 99% of economists and investors remain ignorant of such trends because they have never dealt in the international world of finance and focused only domestically. Those of us who have been hedge fund managers and worked internationally understand the fluctuations of currency and its impact. This is a lesson still not taught in school and politicians remain oblivious to the real implications.

Leave A Comment