There is a lot of pessimism surrounding Apple’s future as the stock hit a new 52 week low yesterday. However I caution investors on making an emotional reaction to this short term momentum. Yesterday the stock price hit technical support at $89.50 which matches the $42 point decline experienced between 2012 and 2013. It’s always interesting to see when sentiment shifts coincide with price hitting technical support or resistance. As oftentimes these events mark important swing lows or swing highs in price. I have no idea whether Apple will bottom at $90, I suspect that if it can’t hold $90 than it’s likely to fall to $75 or so.

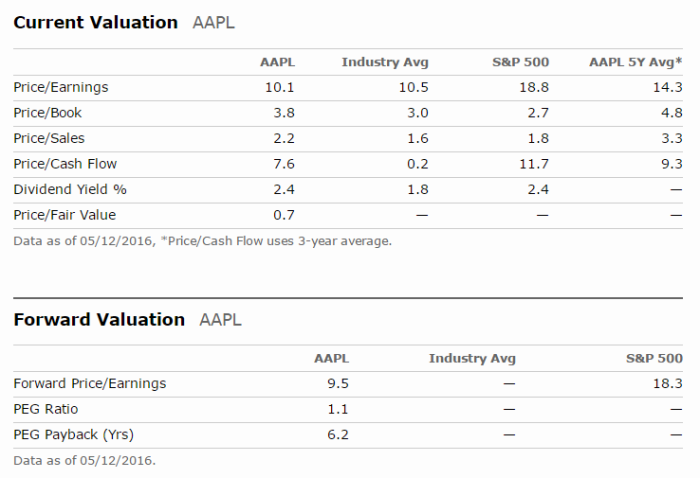

But I ask myself if I didn’t have a position in the stock, would I rather be a buyer or a seller (short) at current levels. And given the valuations, Apple’s continuing profitability and cash position, and the technical support, my answer would be I would much prefer to be a buyer.

Now lets analyze expectations here, if the goal is to outperform the S&P 500 over the next 6 to 12 months or so, well you may be disappointing. But if your looking at the long term, wanting to buy a good company at a good price as part of a diversified portfolio, then look no further than Apple right now.

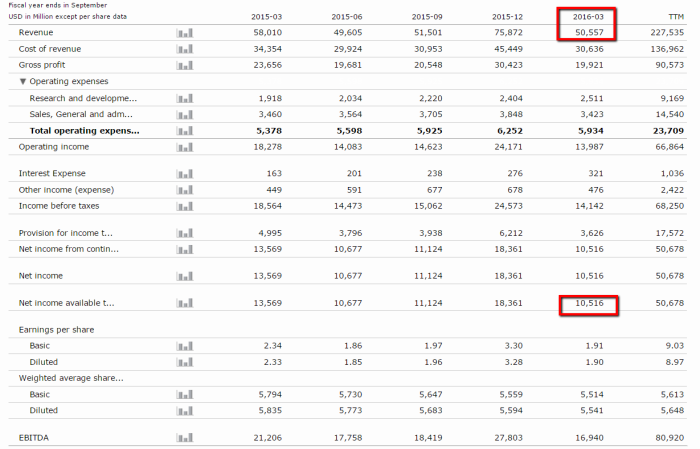

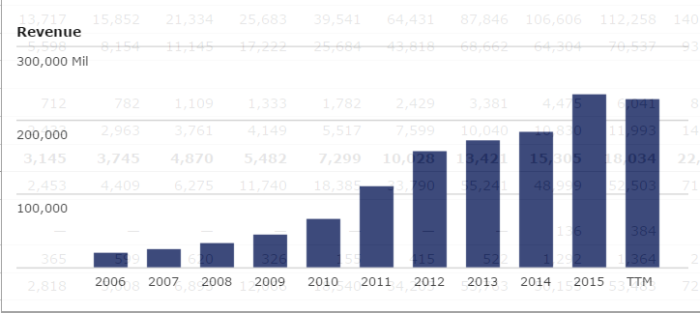

Let’s not forget that the company still earned $10 billion dollars on $50 billion dollars in revenues for the quarter. The decline is in the growth rate of the revenues and earnings, not the earnings themselves.

Apple’s problem is that it had such a great 2015 that all year over year comparisons are likely to disappoint.

But the stock is already down 31% off its all time high, trades 10x earnings and 9.5x forward earnings, which is the lowest PE ratio it’s had in at least 10 years. So there is a good case to be made that the declining growth rate may already be largely priced in.

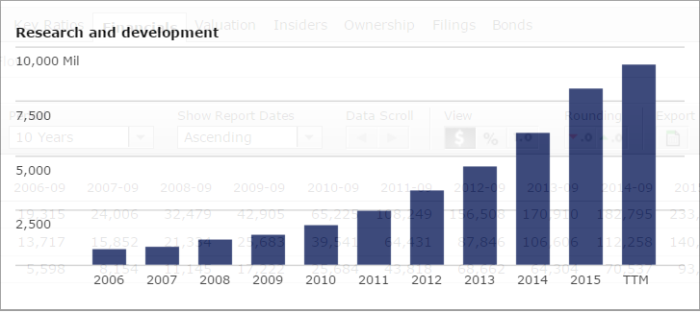

And the steep increases in R & D suggests that Apple may have something up their sleeve.

Leave A Comment