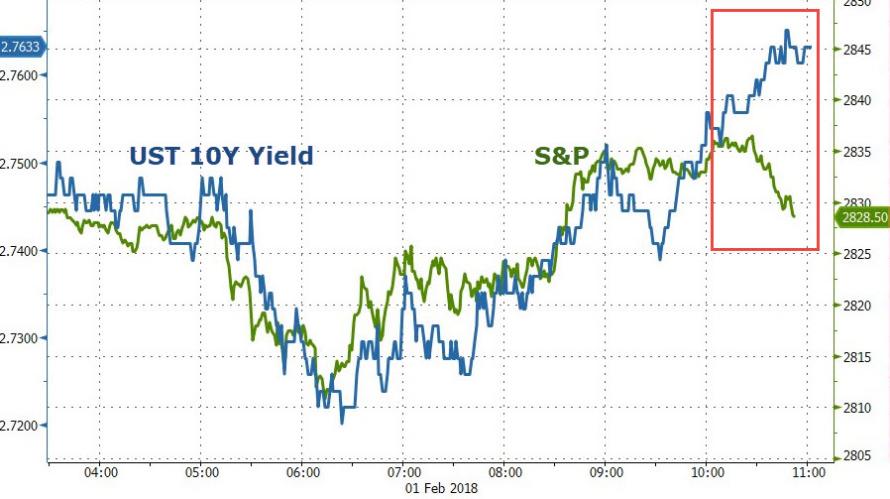

As Treasury yields push to new cycle highs (10Y 2.76 and 30Y above 3.00%), it appears US equities’ post-open panic-buying has disappeared and stocks have sunk back into the red for the day…

Another v-shaped recovery fades…

It appears bond yields spiking sparked stock selling once again…

30Y just broke above 3.00%

As we noted previously, 30Y at 3% was DoubleLine’s Jeff Gundlach’s Second Trigger for bonds to damage stocks (after his first trigger -10Y crossing 2.63% – hit earlier in the month):

Reminding his audience of the rivalry between himself and Bill Gross, Gundlach disagreed with the former bond king, who made headlines today with his statement that the bond bull market is over, and said that “Gross is too early with his TSY bear market call.”

What is the catalyst for Gundlach? As he explained, one “needs to see the 30Y at 2.99% or above for the trendline to break.”

And it just did…

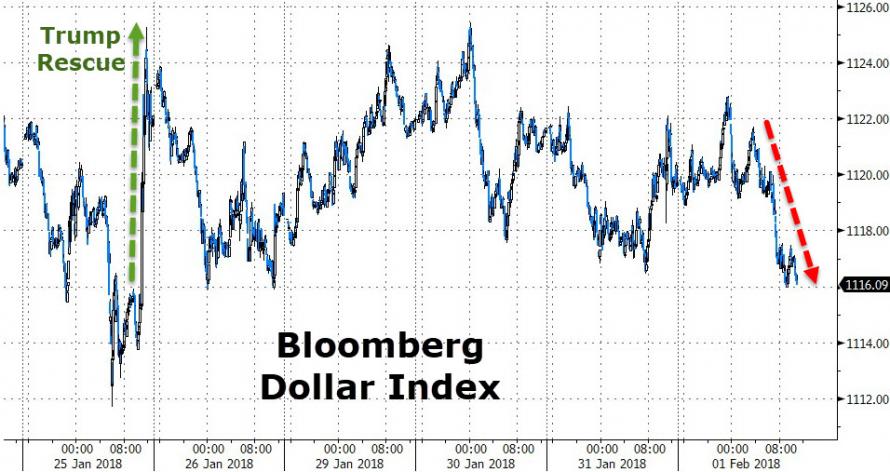

And the Dollar is getting hammered…

But, with AAPL, AMZN, and GOOG reporting tonight, it’s anyone’s guess where we open tomorrow.

Leave A Comment