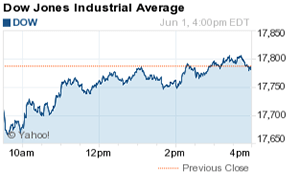

The Dow Jones Industrial Average today (Wednesday, June 1) recovered in the afternoon as improving U.S. factory data helped fuel optimism. However, markets were sliding earlier in the session after negative reports emerged from China on the health of the nation’s manufacturing sector.

Investors are also weighing the timing of the U.S. Federal Reserve’s next interest rate hike. According to CME FedWatch, there’s just a 23% chance the central bank will increase rates in June. That’s down from 32% on Monday.

Here’s what else you need to know about the markets on May 31, 2016.

First, check out the results for the Dow Jones Industrial Average, S&P 500, and Nasdaq:

Dow Jones: 17,789.67; +2.47; +0.01%

S&P 500: 2,099.33; +2.37; +0.11%

Nasdaq: 4,952.25; +4.20; +0.09%

Now, here’s the top stock market news today…

DJIA Today: China’s Manufacturing Woes Return with Great Force

First up, automotive stocks had a mixed day after manufacturers reported monthly sales levels. Shares of General Motors Co. (NYSE: GM) fell 3.4% after the firm reported an 18% decline in May sales. The firm said a recent earthquake in Japan affected its supply chain. Despite the recent downturn, it’s important to remember just how far the automotive company has come since 2009. On this day in 2009, General Motors filed for Chapter 11 bankruptcy.

Sales weren’t very good across the entire sector. Shares of Ford Motor Co. (NYSE: F) fell 2.9% after the firm reported a sharp decline of 6% in light vehicles. Even Fiat Chrysler Automobiles NV (NYSE: FCAU) declined 1.8% today, even though the firm said sales increased by 1.1% in May.

Another day, another deal. Salesforce.com Inc. (NYSE: CRM) announced plans to purchase website software provider Demandware Inc. (NYSE: DWRE) for $2.8 billion. DWRE – whose clients include Lands’ End Inc. (Nasdaq: LE) and L’Oreal SA (OTCMKTS ADR: LRLCY) – saw its stock rally 55.9% on news of the deal.

Leave A Comment