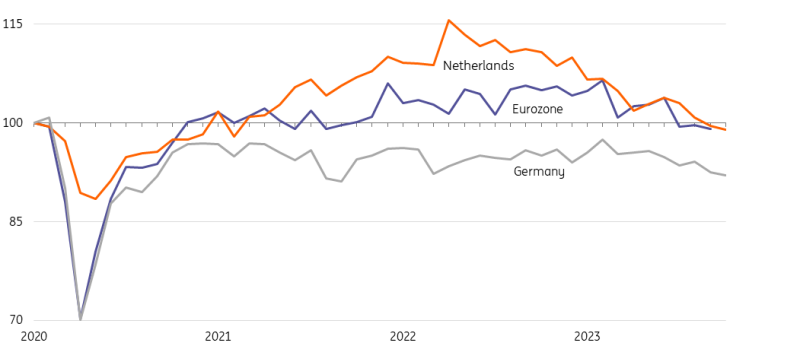

After a tough 2023 with sharp declines, Dutch manufacturing is expected to raise production levels again in 2024, albeit only slightly. Amid persistent demand weakness, a moderate recovery in exports and renewed inventory build-up are expected to be the growth drivers. Shrinking business investment will be a drag on it. Image Source: PixabayStrong production contraction in 2023Dutch industry has seen production decline sharply this year (-6%). Manufacturers are having difficulty getting rid of material and product inventories. Due to previous supply disruptions, these are now larger than usual. Because sales have fallen across the board, destocking is taking a long time and production is under significant pressure. This year, manufacturers of equipment and machines have joined the industries that have been shrinking for some time, such as the chemical industry, base metals and the plastics industry.Small export growth and inventory build-up should ensure modest growth in 2024Inventory levels are increasingly in line with reduced demand. We expect small production growth in 2024, driven by the need to maintain inventories in combination with slightly improving exports. This is likely to offset declining domestic demand for capital goods. Inventory replenishment will also drive some new growth in the global semiconductor industry. Chip machine construction, which is so important to the Dutch manufacturing industry, will only reap the benefits after 2024. In the longer term, demand for chips is likely to increase further. If no economic shocks occur, the need for chip machines will also gradually increase again.From European leader to laggard, but above-average growth on balanceWhile Dutch manufacturing was still ahead of the eurozone after the start of the pandemic, production has fallen relatively quickly over the past year and a half. Although industrial production is stagnating or shrinking in almost all of Europe, nowhere on average has it fallen as sharply as in the Netherlands. Dutch production in October was just below the level just before the pandemic. That is comparable to the eurozone as a whole, but better than Germany, where production was 8% below pre-pandemic levels. On balance, Dutch manufacturing is doing well due to the previous period of excessive growth.Faster growth after corona, faster decline after energy crisis

Image Source: PixabayStrong production contraction in 2023Dutch industry has seen production decline sharply this year (-6%). Manufacturers are having difficulty getting rid of material and product inventories. Due to previous supply disruptions, these are now larger than usual. Because sales have fallen across the board, destocking is taking a long time and production is under significant pressure. This year, manufacturers of equipment and machines have joined the industries that have been shrinking for some time, such as the chemical industry, base metals and the plastics industry.Small export growth and inventory build-up should ensure modest growth in 2024Inventory levels are increasingly in line with reduced demand. We expect small production growth in 2024, driven by the need to maintain inventories in combination with slightly improving exports. This is likely to offset declining domestic demand for capital goods. Inventory replenishment will also drive some new growth in the global semiconductor industry. Chip machine construction, which is so important to the Dutch manufacturing industry, will only reap the benefits after 2024. In the longer term, demand for chips is likely to increase further. If no economic shocks occur, the need for chip machines will also gradually increase again.From European leader to laggard, but above-average growth on balanceWhile Dutch manufacturing was still ahead of the eurozone after the start of the pandemic, production has fallen relatively quickly over the past year and a half. Although industrial production is stagnating or shrinking in almost all of Europe, nowhere on average has it fallen as sharply as in the Netherlands. Dutch production in October was just below the level just before the pandemic. That is comparable to the eurozone as a whole, but better than Germany, where production was 8% below pre-pandemic levels. On balance, Dutch manufacturing is doing well due to the previous period of excessive growth.Faster growth after corona, faster decline after energy crisis

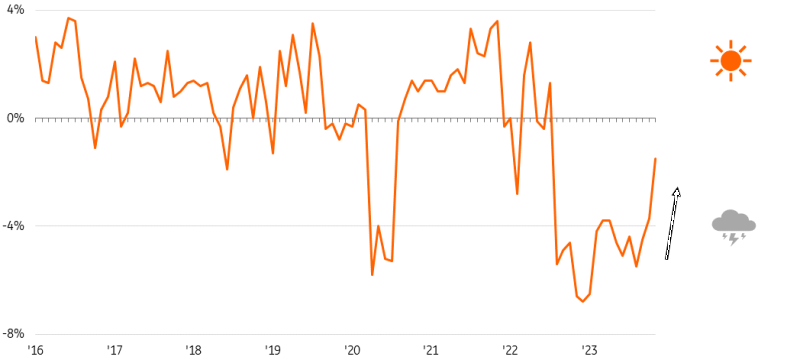

Production level manufacturing industry, January 2020 = 100 EurostatDutch industry is relatively sensitive to recent economic developmentsThe heyday of the relatively large semiconductor industry in the Netherlands has contributed to the strong growth of the manufacturing sector. The effect of this is that the downturn in the chip market is now also hitting the Dutch industry relatively hard – just like the contraction in the cyclically sensitive chemical industry. This industry accounts for twice as much of total industrial production in the Netherlands as in Germany. The production share of the car industry in the Netherlands is only one-fifth of that in Germany. That is the only industry that has shown strong catch-up growth throughout Europe in 2023. That small automotive share has also contributed to the fact that production in industries such as the base metal and plastics industry in the Netherlands has fallen more sharply than in Germany and the eurozone as a whole.Careful recovery of chip demand in 2024, but the machine industry will not yet benefitInternational chip production appears to be cautiously heading upwards. Inventory replenishment could fuel the global semiconductor industry growth by 2024. Technical solutions for the energy transition and artificial intelligence in particular create additional demand for chips, but chip machine construction, which is so important to Dutch manufacturing, will only reap the benefits of this later. Before machine demand picks up again, chip demand will first have to improve substantially. Chip machine makers will therefore continue to struggle with postponed orders for now.Growth is possible again, especially at the beginning of production chainsAs in other energy-intensive industries, the chemical industry is bottoming out. This is indicated by an increase in gas consumption to the highest level in more than a year and a half, a reduction in excess sales inventories and a cautious improvement in order inflow. A real recovery is still pending, but due to renewed stock building, we expect moderate growth at the start of production chains in 2024. This allows the production of basic materials and, to a lesser extent, of semi-finished products to increase again.Depletion of inventories is not yet over, but improvement is on the waySince August 2022, a relatively large majority of producers have assessed their stocks of finished products as too high. However, material purchasing has been declining for fifteen months and a turnaround is not yet visible. Due to previous strong inventory build-ups in response to supply disruptions and a sharp drop in demand, producers have experienced great difficulty getting rid of excess inventories. Only since July 2023 have sales inventories actually become smaller. If this trend continues, some inventory build-up and associated production growth may occur again in 2024. This is expected to take a number of months. Before more can be produced, more raw materials and semi-finished products are needed.Manufacturers less negative about sales stock

EurostatDutch industry is relatively sensitive to recent economic developmentsThe heyday of the relatively large semiconductor industry in the Netherlands has contributed to the strong growth of the manufacturing sector. The effect of this is that the downturn in the chip market is now also hitting the Dutch industry relatively hard – just like the contraction in the cyclically sensitive chemical industry. This industry accounts for twice as much of total industrial production in the Netherlands as in Germany. The production share of the car industry in the Netherlands is only one-fifth of that in Germany. That is the only industry that has shown strong catch-up growth throughout Europe in 2023. That small automotive share has also contributed to the fact that production in industries such as the base metal and plastics industry in the Netherlands has fallen more sharply than in Germany and the eurozone as a whole.Careful recovery of chip demand in 2024, but the machine industry will not yet benefitInternational chip production appears to be cautiously heading upwards. Inventory replenishment could fuel the global semiconductor industry growth by 2024. Technical solutions for the energy transition and artificial intelligence in particular create additional demand for chips, but chip machine construction, which is so important to Dutch manufacturing, will only reap the benefits of this later. Before machine demand picks up again, chip demand will first have to improve substantially. Chip machine makers will therefore continue to struggle with postponed orders for now.Growth is possible again, especially at the beginning of production chainsAs in other energy-intensive industries, the chemical industry is bottoming out. This is indicated by an increase in gas consumption to the highest level in more than a year and a half, a reduction in excess sales inventories and a cautious improvement in order inflow. A real recovery is still pending, but due to renewed stock building, we expect moderate growth at the start of production chains in 2024. This allows the production of basic materials and, to a lesser extent, of semi-finished products to increase again.Depletion of inventories is not yet over, but improvement is on the waySince August 2022, a relatively large majority of producers have assessed their stocks of finished products as too high. However, material purchasing has been declining for fifteen months and a turnaround is not yet visible. Due to previous strong inventory build-ups in response to supply disruptions and a sharp drop in demand, producers have experienced great difficulty getting rid of excess inventories. Only since July 2023 have sales inventories actually become smaller. If this trend continues, some inventory build-up and associated production growth may occur again in 2024. This is expected to take a number of months. Before more can be produced, more raw materials and semi-finished products are needed.Manufacturers less negative about sales stock

Assessment of producers on stocks of end product CBSMore By This Author:Red Sea Avoidance Signals A Disruptive Start To 2024 For Trade And Supply Chains Turkish Central Bank Likely To End Hiking Cycle Next Month November Retail Sales Disappoint In Poland But We Still Hope For A Revival In Spending

CBSMore By This Author:Red Sea Avoidance Signals A Disruptive Start To 2024 For Trade And Supply Chains Turkish Central Bank Likely To End Hiking Cycle Next Month November Retail Sales Disappoint In Poland But We Still Hope For A Revival In Spending

Leave A Comment