Insurance against fiat currency

Billions of people covering a vast land mass around the globe do not have insurance of any sort. Why? It is because they own few assets. No house, no car, just a hovel with no electricity or water at the foothills of some nondescript mountain. By contrast, those who live in advanced economies have assets worthwhile protecting against loss. Thus, we in America have homeowners insurance to protect against the loss of our dwelling, auto insurance to protect against the involuntary conversion of our movement conveyance into scrap metal, and to protect our financial assets against a lawsuit which could strip us of our savings and investment assets in the face of our fault in an automobile accident. Further, we protect our family’s income and savings by purchasing life or disability insurance. We buy insurance because we do have assets, and believe it worthwhile to protect those assets against unforeseeable loss, when the cost of that insurance is affordable.

Why is it then, that we do not protect our assets against the major foreseeable and persistent source of asset loss – that of loss in the value of our currency. Should we not have protection against inflation and the resulting loss of value or purchasing power in our fiat currency represented in our pension funds, stock or bond funds, or savings and money market account assets? We know and acknowledge that inflation robs us of our savings each and every year. Since 1971, even using the contrived statistics used in calculating the Consumers Price Index, the value of a 1971 collar is just worth $0.16 today. That is a very significant loss in value over a relatively short period of time.

We should also protect against the far less frequent, but more significant potential of sudden and near total loss in confidence and value of our dollar. The loss of value due to inflation is a persistent annual event, while rapid substantial loss of a fiat currency in countries around the globe has averaged roughly every forty years. The brutal facts are that no fiat currency in the history of the world has maintained its value. No fiat currency has ever existed in the history of the world that has not failed. Yes, the occurrence of the event is infrequent, but the loss severe. Because our nation in the last decade has accrued a record amount of national debt, the threat of a catastrophic decline in the value of the dollar is increasingly palpable. Therefore, we should insure also against this potential loss event. Since this is insurance against the loss in value of our fiat currency, we will henceforth call it “fiat insurance”.

Availability of fiat insurance

It is likely that the vast majority of people do not have fiat insurance, because one cannot call up an insurance broker or an insurance company to buy such coverage. Insurance companies simply do not have a contract providing restitution for loss in currency value. Traditional insurance is not available, but there are ways of protecting against this potential loss event. And of course, we should have such fiat insurance to protect against both the slow inflationary and more sudden catastrophic loss of value in purchasing power of our entire financial, dollar denominated assets.

Professional money managers of mutual funds hedge their investments in order to protect against rapid or significant loss. This is usually achieved by the use of financial derivatives such as puts and calls. Such hedging is not advised for the average individual investor because of its program sophistication and cost. However, the average investor has a very viable means of purchasing protection against the loss in the value of a currency – by the purchase of physical gold and silver.

Ideally, purchase of popular mainstream gold or silver coins roughly in the dollar amount one pays for auto or homeowners insurance coverage should have already taken place accumulating over the last decade or two. Think of it as paying a premium every year for buying fiat insurance, but with a huge distinction. Traditional insurance paid via an annual premium expires at the end of the policy term with a residual value of zero. However the purchase of this fiat insurance by the purchase of some precious metal coins not only maintains its value, but accumulates over a period of years to a meaningful value as more coins are purchased, saved and stored.

If one does not already have 5-20% of one’s total financial assets in precious metals, then it is advisable, in addition to buying fiat insurance each year henceforth, to make a one-time investment that would represent a meaningful start to such precious metal allocation. It is also possible to allocate some pension or IRA plans to precious metals investments that would increase protection against the loss in fiat currency.

Historical market price of precious metals

Precious metals have famously held their purchasing value for over two thousand years.

One anecdotal observation is that in Roman times a senator could purchase his fancy garb for an ounce of gold, and today an ounce of gold will still purchase a fine suit.Contrary to a piece of paper with fine printing on it, gold will never decline nor maintain a value of zero, which has been the ultimate fate of every paper fiat currency ever issued.

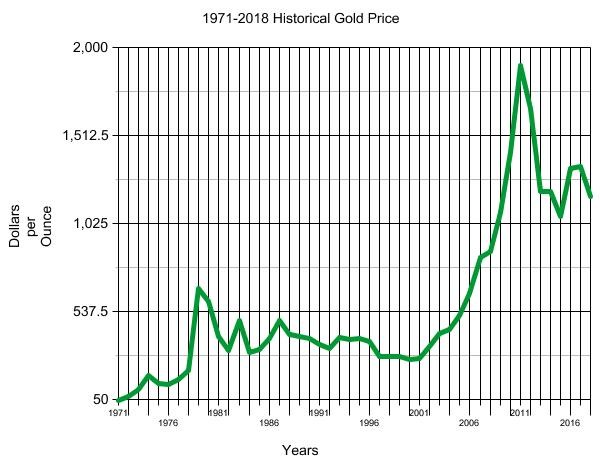

The following chart shows the history of the price of gold since 1971, after the government’s promise to exchange $35 for an ounce of gold among foreign country central banks was broken and discontinued. This default by the U.S. ushered in a new economic period of dramatically increased money printing commensurate with an increase in Treasury debt, and extension of consumer credit. Our national debt today exceeds $21 trillion, with confident projections by economists that government debt will rise to approach $30 trillion over the next decade. The increasing realization that the U.S. will not be able to repay its national debt provides the expectation that our fiat currency will eventually collapse, as the price of precious metals explodes.

First, note that in the late 1970’s when inflation was running at a double digit rate, the price of gold rose about 5 times in a relatively short time period. Note also that this chart shows a five times increase in the price of gold after the meltdown in global markets in 2007, driven by the massive default of mortgage backed securities. As the price of gold started to “run away” in both of these periods, it had to be suppressed in order to maintain trust in the fiat currency.

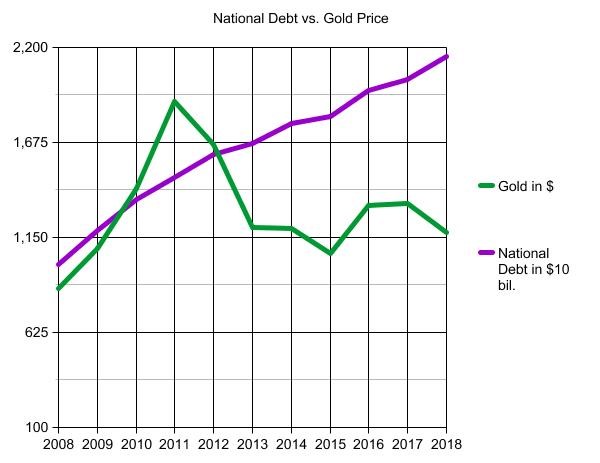

The next chart shows the increase in national debt since 2010, and contrasts it with the stagnant or declining gold price. Note that national debt first exceeded $1 trillion in 1982 (not shown), or two hundred six years after the nation’s founding. However, from 2008 when national debt was $10 trillion, it has exploded to an estimated $21. 5 trillion as of the present moment. Since our nation’s tax base is at $3. 4 trillion, and the interest on national debt is at $456 billion which over the next decade with more normalized interest rates is expected to rise to $1 trillion, the probability in repayment of the government’s debt is truly between slim and none.

During the course of years 2011-2018, the market price of gold and silver has been declining. More dramatically, there is a wide increasing divergence between our growth of national debt and the decline in the market price of precious metals. This divergence cannot happen or be maintained for so many years in a free market. Free markets are consistently analyzed for their logic and price rationale. Such divergence between the debasement of our currency and depressed gold price cannot long endure in un-manipulated markets. Therefore the wise conclusion is that we do not have a free market; instead it is manipulated and controlled.

A rise in gold price in terms of dollars would confirm that unwise government spending, unremitting wars, and persistent borrowing and printing of currency are destroying the dollar and its value; therefore, from the government’s and FED’s perspective, to maintain the illusion that the currency is still sound, any significant rise in the market price of gold must be suppressed, manipulated, controlled, and stopped.

Leave A Comment