By John Benjamin

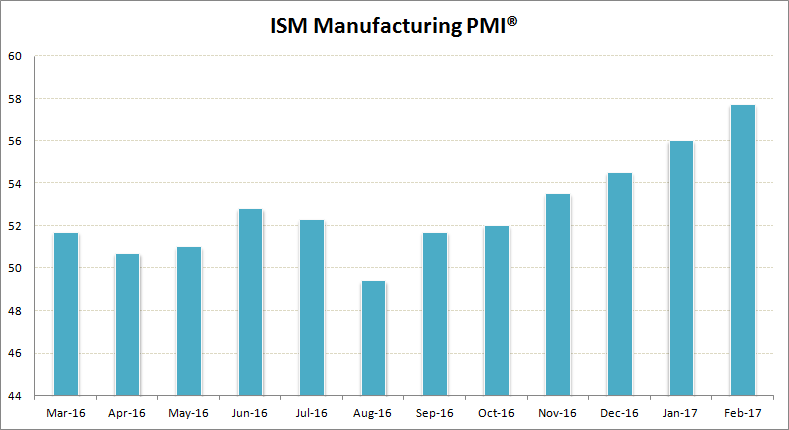

If investors were looking for another reason to be bullish on the U.S. dollar and the Fed rate hike, then last week’s ISM manufacturing data was another reason. The Institute for Supply Management reported last Wednesday that the headline PMI index rose to the highest levels since August 2014 at 57.7 in February, this was an increase from January’s 56.0 print. February’s data also showed that the manufacturing PMI rose for the sixth consecutive month, adding further to the optimism.

Looking into the details, data showed that new orders increased to 65.1 while production jumped to 62.9 in February, up from 60.4 and 61.4 respectively in January. The new orders component was incidentally the largest contributing factor to the higher PMI reading for February. The new orders index at 65.1 was also the highest on record since 2009 when the U.S. economy was seen coming out of recession.

There was, however, some downside as the prices paid index fell to 68.0 in the reporting month, down from 69.0 in January. The employment index was also seen weaker, falling to 54.2 in February from 56.1 the month before.

February ISM manufacturing PMI

With the exception of the above to weak readings on the sub-indexes, overall data continued to point towards expansion in the manufacturing sector which continues to be promising for the economy. The data spurred optimistic comments as the turnaround has been remarkable. It was only in August last year (2015) that the ISM manufacturing PMI was treading the contraction mode of readings below 50 and the sentiment saw a rapid turn-around since October.

The February ISM manufacturing data showed a broad based strength with 17 out of the 18 sectors reporting growth over the last month. This was a significant pick up from just 12 sectors that reported growth previously in January. Most of the upside activity came from domestic demand, but the export orders index showed that there was demand from abroad as well. The index (export orders) was seen rising to 55.0.

Leave A Comment