In my chart analysis, I do not use many of the classical patterns set forth by Schabacker and Edwards & Magee. To me the horizontal (or near horizontal) patterns are far more reliable than the diagonal patterns. I know the implications of the classical patterns, as they are taught by the three gentlemen mentioned, but they very often fail and such pattern failures can be much more powerful.

Another thing to keep in mind is that the classical patterns have strict rules regarding price, volume and duration (time) relationships. Still, I see many charts with these patterns drawn in without taking into account the rules set out for the patterns to be “legitimate”.

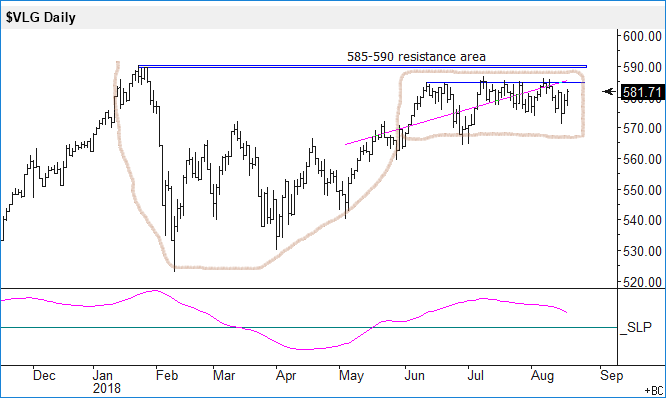

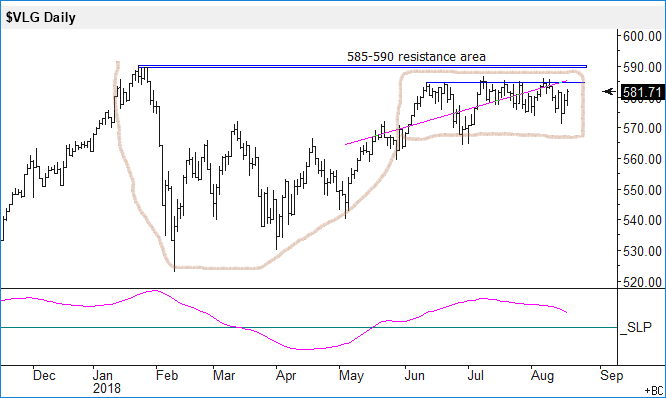

With that said, below is a daily chart of the Value Line Geometric Index. Here is a pattern some would view as a “cup and handle pattern” (I apologize for my bad drawing). I am watching closely the clear horizontal resistance area @ 585-590, since a strong breakout above it could lead to a big up move.

Leave A Comment