The month of October has not been kind to bondholders as the yield curve steepens in reaction to rising inflation expectations. The U.S. 10-year yield moved up as much as 20 basis points. Europe, Japan, and Canada were not spared from the rout in yields, leaving investors worried as to how far the curve steepening will go. Many reasons have been put forth to explain what is happening. Speculation is ripe that the central banks will no longer continue to support the low-interest environment, especially since the Fed has been signaling the need to raise the Fed funds rate before year’s end. In the Eurozone, many observers believe that the ECB will call a halt to its bond-buying program in the not too distant future. And, of course, there is the ever-present concern that inflation will break out.

Inflation and inflationary expectations, above all else, account for changes in the yield curve. Is inflation stirring and is the bond sell-off justified?

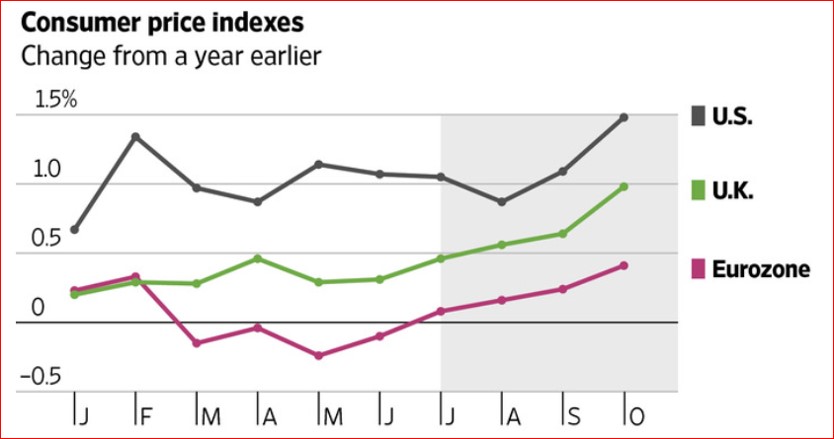

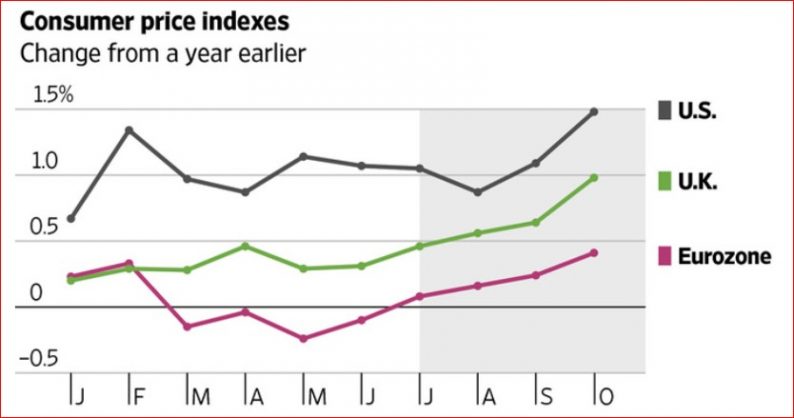

There has been a slight acceleration in the rate of price increases in the U.S., U.K. and the Eurozone (Chart 1). However, the uptick is modest, and rates continue to be well below the 2 per cent target rate set by the central banks.The PCE deflator used by the Fed is running at 1.4 per cent, and actually slowed down in Q3 compared Q2. The U.K. has experienced a spurt in inflation that was caused by the significant devaluation in the pound following the Brexit vote. Finally, the Eurozone suffered from deflation for most of 2016 and now price increases are barely above zero per cent. While there has been a small uptick in consumer prices, on balance, the developed countries are far from an inflationary world that should worry bond holders. On this score, alone, the big sell-off in bonds of late is not justified.

Chart 1 Consumer Price Changes

Turning to the recent performance in the U.S., there is scant evidence of any inflationary pressures (Table1). Both the GDP deflator and the PCE deflator ( the measure favored by the Fed) recorded slower advances in Q3 compared to Q2. Also, personal disposal income advances were moderate and overall aggregate demand showed no signs of accelerating. Neither developments portend greater inflation.

Leave A Comment