Catalysts are mixed and fluid with respect to the ‘automatic’ rally, as I described the likely rebound from the ‘flash crash’ of 2018. It’s been a rebound in a textbook manner that also peaked at a textbook retracement level. And that means ‘risk’ remains in the mix.

Primarily however, as Treasury yields (the 10-year) firmed up again; lots of rationales for low rates to return, along with a benign monetary policy; started to weigh on the optimists who expected more than a temporary rebound for the S&P. We presume bulls will try the upside yet again; but at the same time remain cautious, which is why I previously suspected a rebound; but not necessarily more than a day or two before it’s resisted.

The next couple of months depend more on not just the Budget Deal; or a smart ‘trade policy’ momentum; or even geopolitics (though all matter). It should become a challenge to reignite the degree robust behavior that preceded our unsustainable upside behavior warnings, in later January; leading into our projected early February break and ‘automatic’ rebound.

It’s challenging to say we won’t make a higher high; because markets in the past have swung more dramatically than logical; often based purely on funding availability (not merely liquidity; but foreign fund flows due at least in part to low rates abroad which make the USA an attractive place to pour money). It’s the core of why the Fed (per charts shown before) is able to leave the Funds rate alone for awhile longer; while rolling off the Balance Sheet just as they indicated for months would be forthcoming.

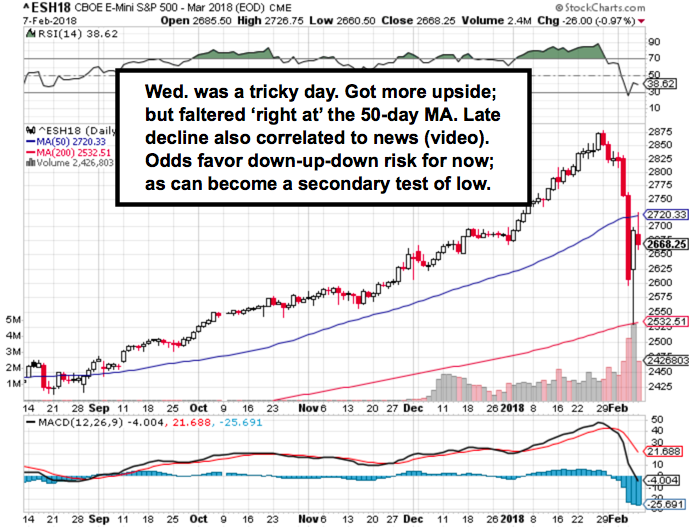

In sum: the rebound overall rebounded ‘conveniently’ to the S&P’s 50 Day Moving Average; horsed around; and then tanked in the last part of the day. It is ‘possible’ they will try again tomorrow; but hesitate with the Senate Budget Accord unlikely to find automatic House support; though if it does there will certainly be some relief.

Leave A Comment