Let’s start with Japan where the BoJ took the markets by surprise by pushing the benchmark rate into negative territory (taking a lesson from the ECB).

In a stunning move of “competitive devaluation”, the BoJ “retaliated” against China’s recent currency depreciation and the ECB’s threats of further easing. Welcome to currency wars.

The yen weakened sharply in response (shown below is USD rising vs. JPY).

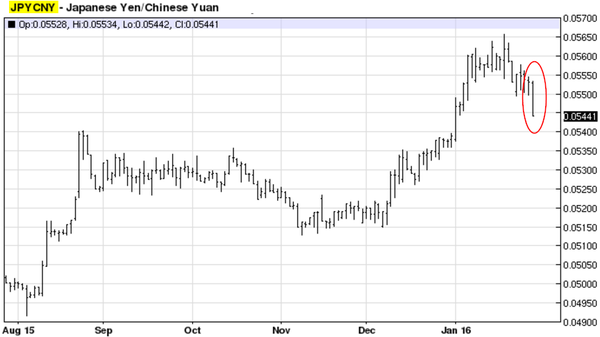

The next chart shows the yen/renminbi exchange rate. That appreciation in recent weeks was not welcome news for the BoJ and Haruhiko Kuroda is now giving it back to the PBoC.

The 10yr Japanese government bond (JGB) yield hit a record low.

Here is a longer-dated 10yr JGB yield chart.

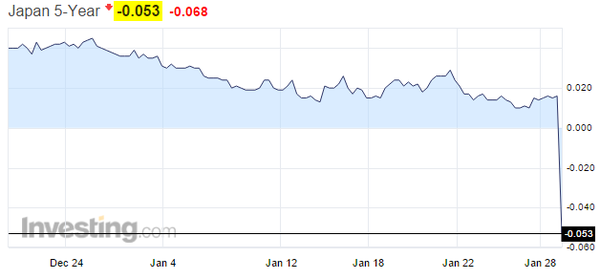

The 5-yr JGB yield went negative for the first time.

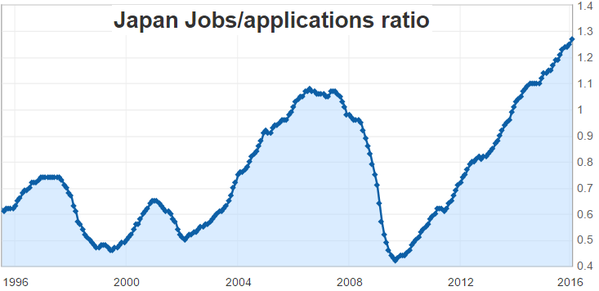

The BoJ of course was fully justified in taking further easing action. In spite of tight labor markets (below), …

Source: Investing.com

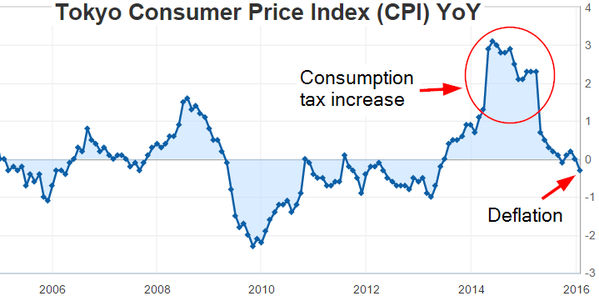

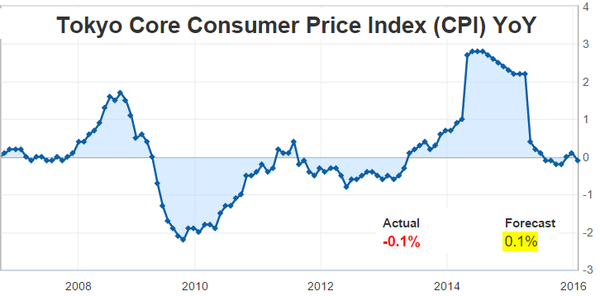

… inflation continues to underwhelm. Here is the Tokyo CPI, which comes out 1 month ahead of Japan’s national CPI.

Source: Investing.com

Source: Investing.com

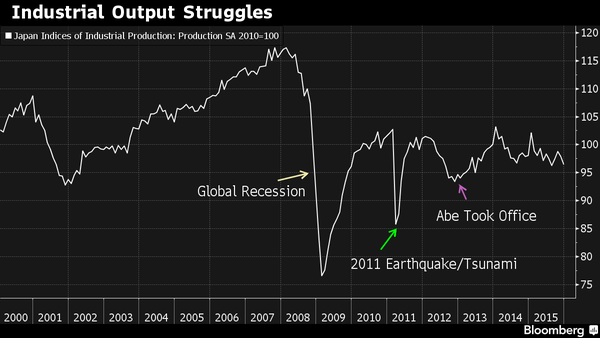

Moreover, industrial production declined and so did household spending.

Source: @business

By the way, this may be an interesting lesson for the Fed. While the labor market in Japan is much tighter than in the US, that hasn’t translated into inflation.

Also to put the global situation into perspective, the Fed is now completely isolated in its quest to “normalize” rates. Additional easing is taking place in the Eurozone and now in Japan. The BoE and the BoC both struck a dovish tone. China is likely to ease again and/or allow the RMB to fall further. And the Fed is talking about 4 rate hikes in 2016. Really?

Staying with Asia, here are a few updates.

1. This is South Korea’s manufacturing sentiment index.

Source: Investing.com

2. Taiwan enters a recession as the GDP shrinks for a second quarter.

Leave A Comment