Wabtec (WAB) provides equipment and services to the global rail industry. Its Freight division (60% of revenue) manufactures and services components for new and existing freight cars. Transit (40% of revenue) manufactures and services components for transit vehicles, typically subways and buses. The company is highly-dependent upon the health of the global freight rail and passenger transit industries.

Freight Revenue Will Continue To Slow

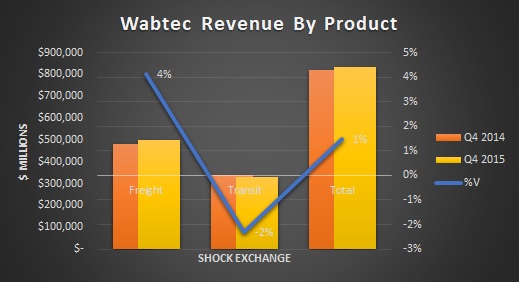

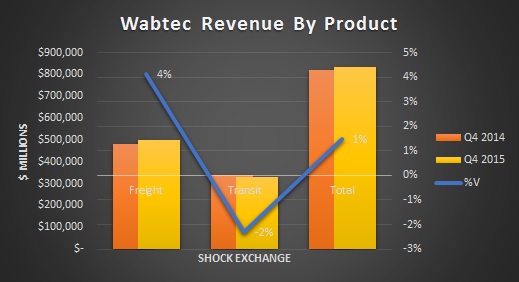

Wabtec’s Freight division continues to be a catalyst for growth; its revenue was up 4% Y/Y while the Transit unit fell 2%.

Freight could experience headwinds going forward. U.S. rail traffic for March 16th fell nearly 12% Y/Y. Declining demand by businesses to ship goods and services cross country could hurt revenue for railroads. It in turn, it could reduce their demand for freight cars and components sold by Wabtec. Secondly, rail car traffic is a harbinger of economic activity; a declining U.S. economy would not be good for a cyclical business like Wabtec’s in general.

The company made seven bolt-on acquisitions in full-year 2015 which buoyed its top line. It is also in talks to acquire Faiveley Transport S.A., a provider of integrated systems and services for the railway sector, for $1.8 billion. The deal could increase revenue by one-third. However, a lack of organic growth has been masked by acquisitions. It could get worse as revenue delivered from the backlog is expected to decline 20% from $1.5 billion in full year 2015 to $1.2 billion this year.

Time To Cut Costs?

WAB is now 16% Y/Y versus a flat return for the S&P 500 SPY. It also trades at 19x earnings, yet its earnings growth does not reflect that of a growth stock. Its operating income margin of 18% for Q4 2015 was slightly higher than the 17% achieved in the year earlier period. Given anemic top line growth and an expected decline in revenue from the back log, management may need to improve operating margins to justify its p/e multiple.

Leave A Comment