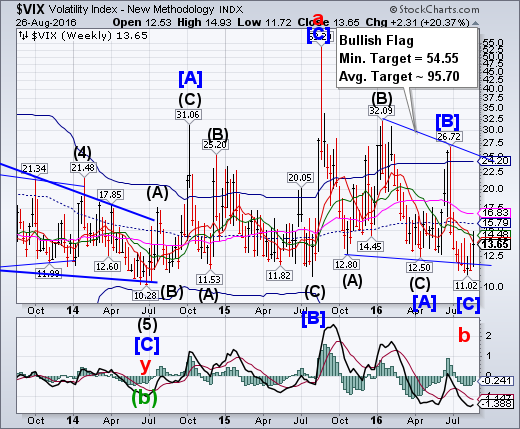

VIX challenged both Short-term and Intermediate-term resistance this week, but closed beneath the Short-term at 13.82. However, it has made a breakout above the last down-cycle high of 14.24. The next important milestone is mid-Cycle resistance at 15.79 where a buy signal may be made.

(Bloomberg) August 2015 was a terrifying time for investors, with the imminent withdrawal of Federal Reserve stimulus and China’s currency devaluation sending stocks on their wildest ride in four years. Twelve months later, it’s nothing but calm.

Stock turbulence has been banished as the CBOE Volatility Index, which saw its biggest one-day spike on record in last year’s selloff, now sits 40 percent below its decade average. Fed funds futures that priced in as many as four interest-rate hikes a year ago see only even odds of one before 2017. The yuan keeps sliding, but few seem to notice.

SPX reverses from its trendlines

SPX made a second challenge of the confluence of two upper trendlines of two different Orthodox Broadening Tops on Monday and failed to make a new high. It reversed beneath its Cycle Top resistance at 2188.89, closing above Short-term support at 2150.18. SPX has fulfilled all the fractal requirements for a completed uptrend.A significant low may be due by the end of the coming week.

(Bloomberg) What had been just a sleepy August is turning into an increasingly painful one for U.S. equity market bulls.

Notwithstanding an hour-long burst of optimism that followed Federal Reserve Chair Janet Yellen’s policy speech Friday, the buoyancy that lifted stocks for the first half of the summer has now been missing for the better part of a month. The S&P 500 Index fell 0.7 percent to 2,169.04 this week, the biggest drop since June, to erase its August gains.

NDX closes beneath its Cycle Top

NDX slipped beneath its weekly Cycle Top at 4804.08, but with no gain for the week.It has reached its fractal target of 4732.24 on August 3 and peaked on August 9. A slip beneath the Cycle Top may indicate a reversal is in motion.

(ZeroHedge) Unlike many of the sentiment indicators we’ve looked at recently, traders on one options exchange recently exhibited a record show of nervousness.

We’ve written a fair amount recently about the growing level of optimism, or complacency, evident in many corners of the stock market. Indeed, overly exuberant sentiment is probably the most troublesome factor in the markets right now. There is nary a time, however, when all signals and indicators are in alignment with one another. The present is no exception. And in fact, the traders on one options exchange recently demonstrated a record level of cautiousness.

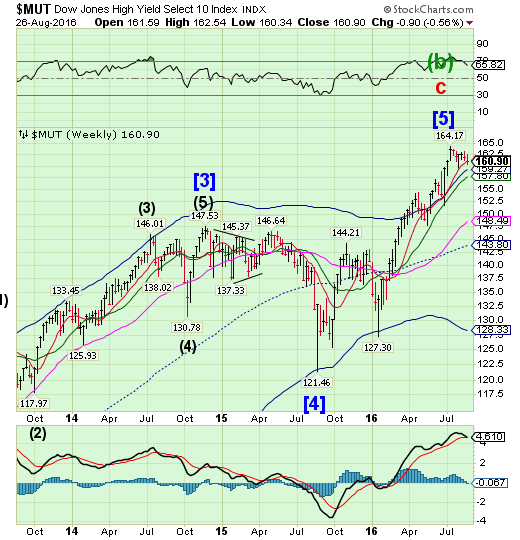

High Yield Bond Index has declined to Short-term support

The High Yield Bond Index declined beneath its Short-term support at 161.15 for a probable aggressive sell signal. Wall Street is furiously issuing new products as they see the window closing soon.

(MoneyMorning) The high?yield bond area has been a Petri dish for misapplied financial theories and assumptions for years.

High-yield bonds are properly understood as hybrid securities that possess the characteristics of both debt and equity. Yet most investors in this asset class focus on the “spread” at which a bond trades. The spread is the number of basis points (1/100th of a percentage point) above a benchmark yield at which a bond trades. In the case of high-yield bonds, High-yield bonds are considered the benchmark on the basis that they are riskless securities (an assumption that itself is questionable in view of the United States’ increasingly precarious fiscal posture). Spread represents the risk premium that investors demand for owning a security that is riskier than a Treasury bond.

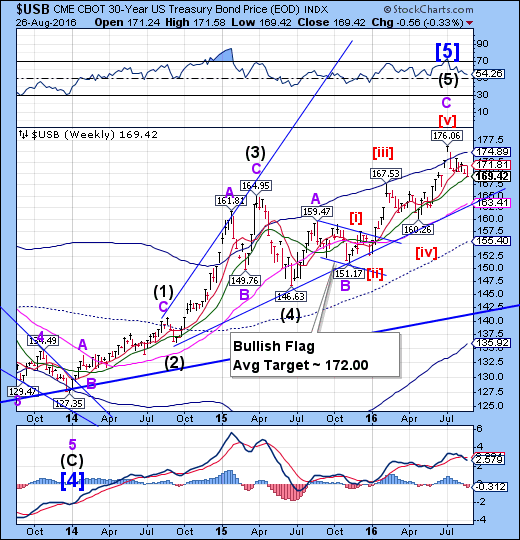

USB declines to Intermediate-term support

The Long Bond declined toward Intermediate-term support at 169.25.A break of that support may threaten the Long-term support and the Broadening Wedge trendline at 163.41.Should it break through Long-term support, a potential decline to its 34.4 year trendline at 142.40 may be indicated.

(WSJ) U.S. government bond yields rose Friday after comments from Federal Reserve officials revived bets that U.S. interest rates will rise this year.

Leave A Comment