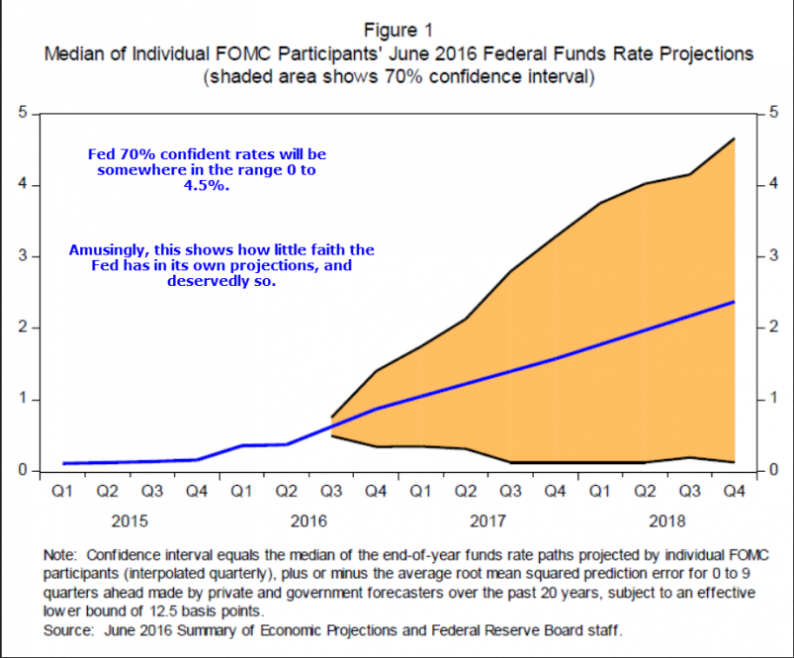

Jackson hole did little more than make Fed Chair Janet Yellen look like a blithering fool.

Her chart of confidence levels on interest rates was just one of many silly things.

Here’s a roundup of tweets and posts that shows what I mean.

Proof Economists’ Style

Proof looks like this at #JacksonHole. No empirical evidence needed.

Proof looks like this at #JacksonHole. No empirical evidence needed linking policy to substantive economic outcomes pic.twitter.com/7uLOgc7RA9

— John P. Hussman (@hussmanjp) August 28, 2016

Investigating the Crisis

Pre-crisis look at gap Fed has created between financial valuations and economic activity.

Pre-crisis look at gap Fed has created btwn financial valuations and economic activity. Note collapses #JacksonHole pic.twitter.com/yh7VQKT2Ap

— John P. Hussman (@hussmanjp) August 28, 2016

Can It Be a Bubble If Everyone Thinks So?

Best chart of the week https://t.co/C5tFMrQo3B

— Peter Atwater (@Peter_Atwater) August 28, 2016

Jackson Hole Postmortem

ZeroHedge provides a summary of quotes in his Jackson Hole postmortem: “It May Take A Massive Program, Large Enough To Shock Taxpayers”

And once again here’s a chart from Yellen’s own presentation.

Fed Confidence Levels

Related Articles

Mike “Mish” Shedlock

Leave A Comment