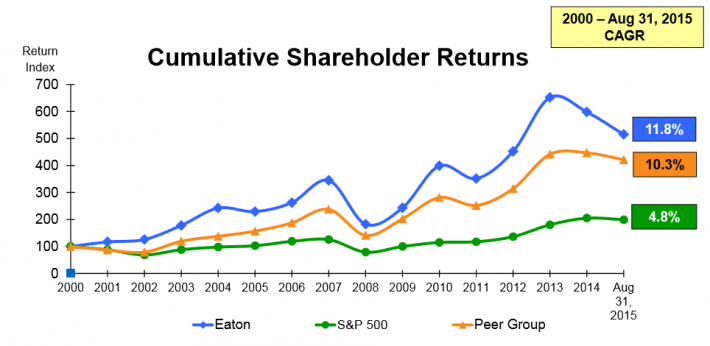

Eaton Corporation (ETN) looks cheap at first glance. The company has a price-to-earnings ratio of 11.5 and a dividend yield of 4.2%. Even better, the company has given investors better total returns than the overall market over the last 15 years:

Source: Eaton Citi Industrial Conference

Is the company truly an undervalued gem, or is there serious trouble at Eaton?

This article takes a look at the investment merit of diversified manufacturer Eaton.

Eaton was founded in 1911. The company currently has a market cap of $24.7 billion. The company’s shares have not done well over the last several months. The company’s stock price is down about 24% in the last quarter alone.

The company’s share price has fallen so far due to weakness in the industrial manufacturing industry.

Eaton operates in 2 large ‘sectors’: electrical and industrial. The electrical sector generated 61% of the company’s sales in 2014, while the industrial sector generated the remaining 39% of sale.

The electrical sector provides comprehensive solutions from power generation through to the end user. The sector is further broken down into 2 divisions:

The industrial sector operates in 3 divisions:

The Eaton Citi Industrial Conference gives a visual breakdown of the company’s sectors and divisions:

Weakness is a result of the beginnings of a global economic slowdown. Hydraulic revenue fell 18% percent in the company’s most recent quarter. Revenue was down (though not as much) in all of the company’s other divisions in the quarter.

There are a myriad of factors reducing sales for Eaton. Low agriculture prices are reducing hydraulic purchases from companies like Caterpillar (CAT). Low oil and gas prices are impacting global energy segment sales, and vehicle sales are being impacted by growth slowdowns in China and South America.

Leave A Comment