BigTrends Weekly Market Outlook

What started out as a fairly bullish week didn’t end as one. The Federal Reserve’s decision to not raise the nation’s key interest rate inspired just enough doubt about the health of the global economy to send stocks lower on Friday. It was just enough of a stumble to pull stocks back into the red for the entire week.

And yet, there’s still a way for the pullback to stop before it gets started in earnest.

We’ll dissect that narrow path below, after taking a look at last week’s key economic numbers.

Economic Data

There’s no denying that the Fed’s decision to hold the Fed Funds rate at 0.25% last week was “the” big news, but it’s not the only economic news worth a closer look. We also heard last month’s retail sales results, August’s consumer inflation figure, and the number of housing starts and building permits the nation logged for last month. In order of appearance…

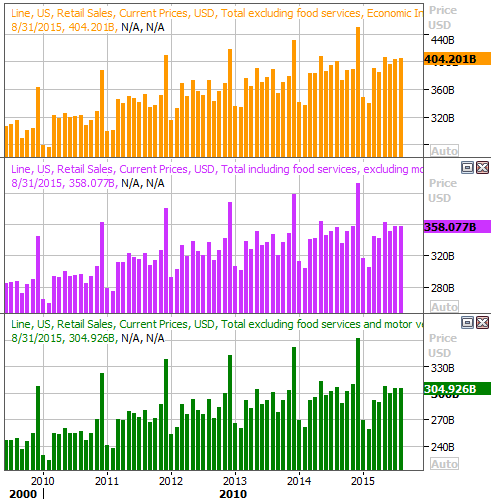

Retail sales for August were up, but not as much as expected, and not up impressively. Economists were looking for overall growth of 0.3%, and we only saw growth of 0.2%. Taking automobiles out of the equation, retail sales growth of 0.1% fell short of the 0.2% growth the pros were calling for.

Retail Sales Chart

Source: Thomas Reuters

No chart necessary for last month’s inflation data – the annualized rate now stands just under 0.2%, near where it’s been for several months now. Even taking ultra-low oil/gasoline prices into account, however, the core inflation rate is standing at a very palatable 1.8%. There’s little inflation for the Fed to try and fend off.

Last but not least, on Thursday we got housing starts and building permits for August. Permits were up, and starts were down. And, starts were better than anticipated while permits fell short of estimates. Regardless, both remain in bigger-picture uptrends.

Building Permits, Housing Starts Chart

Source: Thomas Reuters

Leave A Comment