Since hitting rock bottom in 2009, stock prices have consistently increased without much volatility–that is, until these first few days of February when the Dow Jones Industrial Average fell over 2,200 points (-8.5%) and the S&P 500 tumbled 7.9% from their late-January highs. The most popular measure of stock market volatility, VIX, also spiked dramatically to levels not seen since 2011 and 2009.

Financial analysts and writers have pointed to a few events that may be behind the big movements in the stock market:

But to really get to the bottom of the current stock market decline, we need to go back to the Federal Reserve’s response to the 2007-08 crisis.

Unprecedented Monetary Policy

During that financial and economic collapse, the Federal Reserve responded in unprecedented ways. We saw the biggest expansions of credit and the lowest interbank lending rates ever.

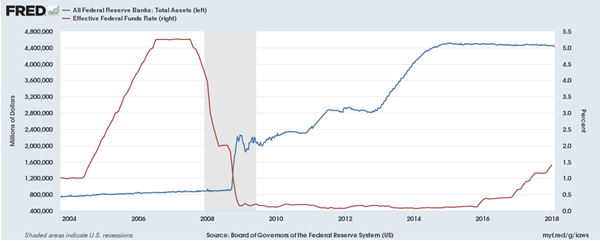

(The blue line above shows the Federal Reserve’s balance sheet expansions. The red line is the Federal Funds Rate, or the rate banks pay each other for loans. It is viewed as the basis for all other loan rates in the US. Together, these show the unprecedented expansionary monetary policy of the Fed in response to the most recent recession.)

The Federal Reserve was pouring trillions of dollars into the financial sector and banking system and making it cheaper than ever for those firms to borrow in an attempt to stimulate more spending and employment throughout the economy. They wanted home prices and asset prices (including stocks) to stop falling and return to the seemingly irreversible positive trend they had through the mid-2000s.

Leave A Comment