Gilead Sciences (GILD), the dominant antiviral and hepatitis drug company, is starting to draw a lot of attention from value oriented investors due to its decline of 23% over the past year.

Gilead’s stock now trades at a high-single digit price-to-earnings multiple which typically has many bargain hunters salivating, especially in a market where many quality blue-chip stocks and dividend aristocrats trade at over 20x earnings.

Furthermore, Gilead initiated a dividend in the second quarter of 2015 for the first time since the company’s founding in 1987 and now yields 2.4% with strong dividend growth potential.

With a low payout ratio, cheap P/E multiple, and a history of phenomenal growth, should dividend investors jump on the opportunity to own a stock that has returned nearly 400% over the last decade or are they getting lured into a value trap?

Business Analysis

Gilead Sciences is a global biopharmaceutical company that discovers, develops, and commercializes innovative medicines in areas of unmet medical needs.

Gilead’s main focus is on human immunodeficiency virus (HIV), liver diseases such as hepatitis, oncology and inflammations, and cardiovascular and respiratory conditions.

In 2015, they generated sales of $32.6 billion, the most in company history. Their main competitors in the industry include other large global biotechnology and pharmaceutical companies. Their products compete based on efficacy, safety, tolerability, acceptance by doctors, ease of use, insurance coverage, distribution and marketing.

Gilead’s main therapeutics are Harvoni (Liver Diseases), Sovaldi (Liver Diseases), Truvada (HIV), Atripla (HIV), Stribild (HIV), Complera/Eviplera (HIV), and Viread (Liver Diseases). All of these therapeutics generated sales in excess of one billion dollars in 2015.

Gilead has significant revenue concentration from its main drugs. The company’s top ten drugs generated around 97% of their revenue in 2015 with the top three generating around 69%.

Furthermore, their top therapeutic, Harvoni, generated sales of about $13.9 billion, or nearly 43% of their total revenue for the year.

It goes without saying that dividend investors need to be very comfortable with the outlook for these drugs to ever consider investing in Gilead Sciences regardless of the attractiveness of the valuation and the current important financial ratios.

The patent protection periods on their top drugs look okay with Harvoni covered until 2030, Sovaldi until 2029, Truvada until 2021 (but only 2017 in the European Union), Atripla until 2021 (but again only 2017 in the EU), Stribild until 2029, Complera/Eviplera until 2022, and Viread until 2018.

Thus, with the benefits of patent protection lasting for at least 4-5 years on their major drugs, and much longer on Harvoni, then why are the shares so cheap today?

It all comes down to the market believing that Gilead’s best days are behind the company. After all, it’s hard to imagine the company’s surge in margins earnings the last few years will be repeated (or possibly even sustained).

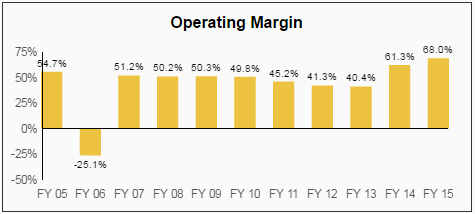

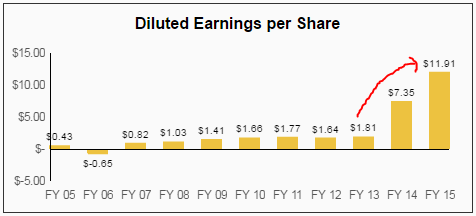

As seen below, Gilead’s operating margins surged from roughly 40% in fiscal year 2013 to nearly 70% in 2015 thanks to high-priced treatments Sovaldi (FDA approval in late 2012) and Harvoni (released in October 2014). Diluted earnings per share increased by a factor of 10 from 2013 to 2015.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Product sales for their HIV and liver disease areas were down 1.3% for the six months ended June 30th, 2016, with the decline accelerating in the second quarter for a nearly 6% slump.

Leave A Comment