Lael Brainard spoke at a widely-awaited speech yesterday in what should be the last prepared remarks from a Federal Reserve member ahead of next week’s rate decision: This is known as the ‘blackout period’ for FOMC, in which the bank attempts to limit public appearances and planned speeches in the effort of not tampering with market expectations around a rate decision.

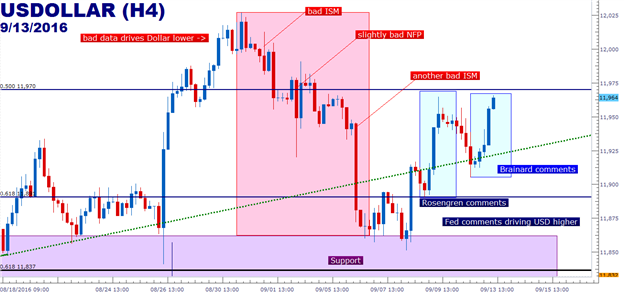

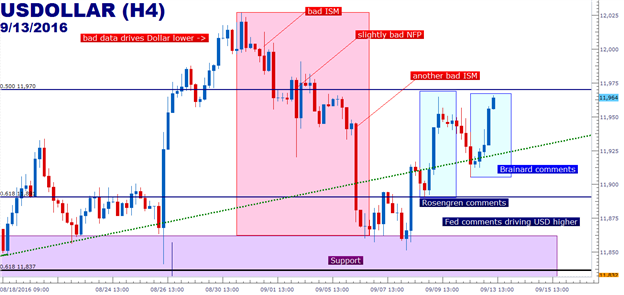

And while Ms. Brainard’s comments were relatively dovish, it would appear that she wasn’t as dovish as what markets were looking for as the US Dollar has continued to run higher since she spoke; and that furthers a theme that’s been rather prevalent since last Thursday when the Greenback bounced off of a key zone of support. We looked at that setup in the US Dollar last week in the article, Is the US Dollar Done Until December; and as we said, despite the fact that a hike in September looked very unlikely, the Dollar was likely going to remain volatile as driven by FOMC commentary around near-term rate decisions, particularly next week’s meeting on September 20-21.

Shortly after that article was published we heard from another Fed member that seemed to catch markets by surprise when Eric Rosengren of the Boston Fed alluded to the fact that low rates may be bringing on more risk in the Fed’s outlook than an actual rate hike. This may be seen as somewhat similar to Alan Greenspan’s ‘irrational exuberance’ comments near the top of the tech bubble as the prior head of the Federal Reserve tried to explain the outlandish valuations that were being traded in technology stocks at the time. The Fed is aware that loose monetary policy can drive risk markets higher; and should policy stay too loose for too long, moral hazard can increase as investors, banks and even pension funds take on considerable risk under the guise that the Fed will continue to support the trade with low rates.

Created with Marketscope/Trading Station II; prepared by James Stanley

Leave A Comment