Over the past several months, I’ve noticed a large number of bullish articles on Goodyear Tire & Rubber (NASDAQ:GT). (See the above video from Aug. 18.) The basic thesis is that management is strong, the company has successfully been turned around, and that it’s become the most efficient tire producer in the world. The bulls view GT as undervalued at current prices with the low P/E ratio being cited as one reason to buy.

I found the bull cases compelling enough so that I thought it would be worthwhile to check it out for myself. While I’m certainly impressed with the job management has done at Goodyear, my views on the stock itself are a bit more neutral. To me, the stock looks perhaps slightly undervalued and I can see legit reasons to buy in as management continues the current transformation. Nevertheless, Goodyear lacks the “margin of safety” I personally seek out in investments.

Overview

First things first; let’s summarize Goodyear’s operations. As most of you already know, The Goodyear Tire & Rubber Company manufactures and markets tires. It was founded in 1898 in Akron, Ohio and major competitors include Michelin (OTCPK: MGDDF), Bridgestone (OTCPK:BRDCY), Pirelli (OTCPK:PPAMF), and Cooper Tire & Rubber (NYSE:CTB).

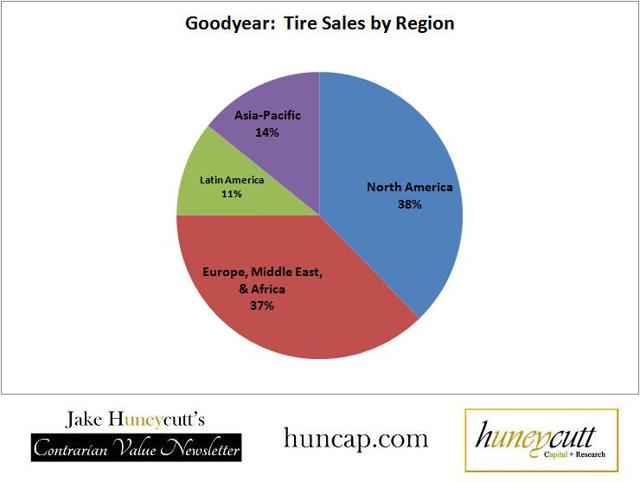

Goodyear operates globally, with about 38% of its tire sales in North America, 37% in Europe and the Middle East, 14% in Asia-Pacific, and 11% in Latin America. Latin America may provide the best growth prospects moving forward and GT is planning on opening a new factory in Mexico by 2017.

Goodyear is also one of the more surprisingly complex large cap companies I’ve come across that’s not a bank or insurer. The reason I say that is because it consistently has a lot of oddball items in its earnings reports. It is also subject to significant foreign currency swings and has a defined benefit pension plan. All of this is on top of operating in a very cyclical industry and having a significant debt load. For these reasons, there is a lot of room for interpretation when it comes to valuing GT.

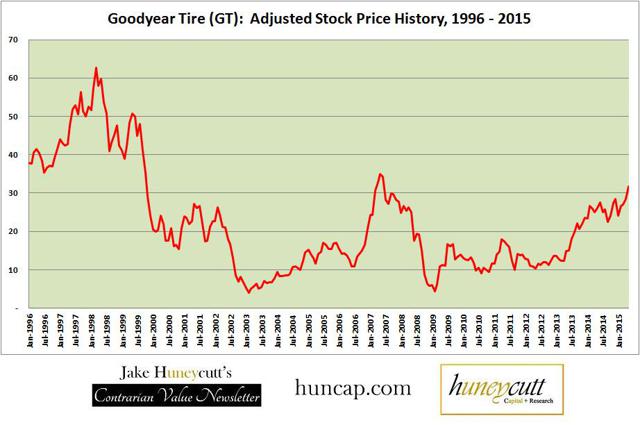

Over the past few decades, Goodyear has made a rather poor investment. It’s really only in the past few years that it’s started to see significant improvement. The chart below shows Yahoo Finance’s “Adjusted Stock Price” history, which takes into accounts splits and dividends. As you can see, GT was a pretty big loser up till around mid 2013.

If you had bought into GT in January 1996, even with the surge over the past few years, you still would’ve lost about 25%; an extremely dismal return. Nevertheless, companies change and there are reasons to be much more optimistic about Goodyear’s future.

The Bull Cases

With that overview, let’s now take a look at some of the more well articulated bull cases on Goodyear.

Anthony Ruben: Goodyear Has Good Tailwinds and Reasonable Valuation

Ruben makes one of the most compelling cases for Goodyear I’ve seen. He points out that Goodyear has an attractive niche in North America with high-value added tires, a market that’s increasingly growing. He believes that Goodyear will see a lot of attractive tailwinds in the upcoming years, including lower oil prices, a stronger North American economy, improving economic situation in Europe, and tariffs on Chinese imported tires. Anthony also views GT’s e-commerce site, reduced operating costs in the New Mexico plant, and a fully-funded pension as big plusses moving forward. At the current price of $30, Ruben believes GT is about 20% undervalued and has room for potential upside surprises on earnings.

Jake Hannah: Why Goodyear Tire & Rubber is a Steal at Current Prices

Hannah likes Goodyear’s high earnings yield of 37% and strong return on equity of 93%. Hannah believes it’s a strong buy. I tend to disagree strongly with Hannah’s reasoning. As we’ll explore in this article, I believe GT’s earnings are deceiving due to one-time items and result in inflated stats and multiples. While earnings are strong, several adjustments are needed to “normalize” income for Goodyear and come up with more reasonable earnings and cash flow estimates moving forward.

Leave A Comment