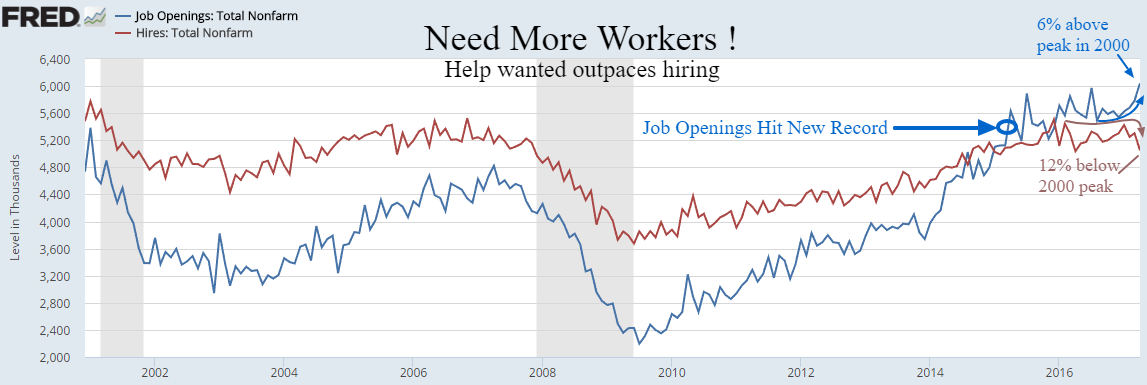

More jobs and less available people should portend better pay. Everyone knows that when demand is greater than supply, the cost of the supply will rise until equilibrium is reached. That’s certainly the case with housing these days as the record low inventory of homes can’t satisfy the demand. As one would expect, housing prices have risen beyond their 2007 bubble peaks in Europe and the US, helping to boost apartment rentals as well. Yet, when it comes to our labor market, it’s a conundrum for most economists. We have near record low unemployment and record high job openings (6 Million+). So why are we seeing below normal wage growth?

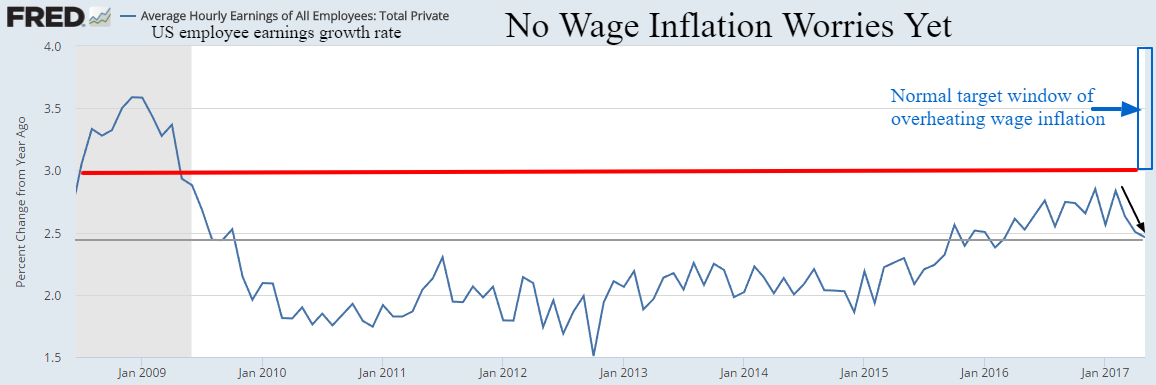

Normally we expect economic cycles to generate peak wage inflation of 3 to 4%. The historically tight labor market and surplus of job demand over hiring, one might expect record employee earnings in this expansion above 4% instead of the current 2.5%.

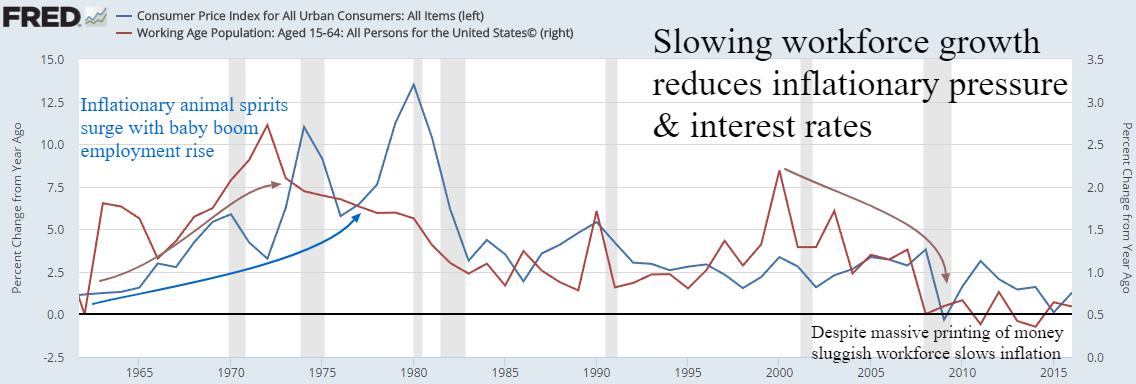

Demographics and declining labor force growth rates have contributed to this slow wage inflation cycle. There was a marked deceleration in our labor pool expansion in the 1980’s and further contraction since 2007. This has reduced the inflationary pressure on resources and capacity that was common in previous decades. Without skilled immigration, this trend is unlikely to improve as all Western countries will see reductions in their working age populations relative to total population from now until 2030.

Wages could still accelerate toward traditional 3 to 4% peak growth rates as long as job demand outstrips labor supply, it will just take a longer than normal expansion to find and exceed equilibrium. Labor is currently tight with U3 unemployment of 4.3%, closing in on a 48 year low of 3.9% set in 2000. Educated worker unemployment has fallen under 2.7% and has made it very challenging for companies to satisfy their demand – especially small businesses who can’t afford to outbid mega-companies. The slimmed down labor pool is holding back some of the animal spirits that might provide accelerated investment and inflation of the GDP.

Leave A Comment