“The Bear Market Is Dead, Long Live The Bull.”

You could almost hear the chants from the always bullish biased media this week as the markets ripped higher on“first day of the month” portfolio rebalancing and short-covering by fund managers.

The rally, as discussed this past weekend, was not unexpected:

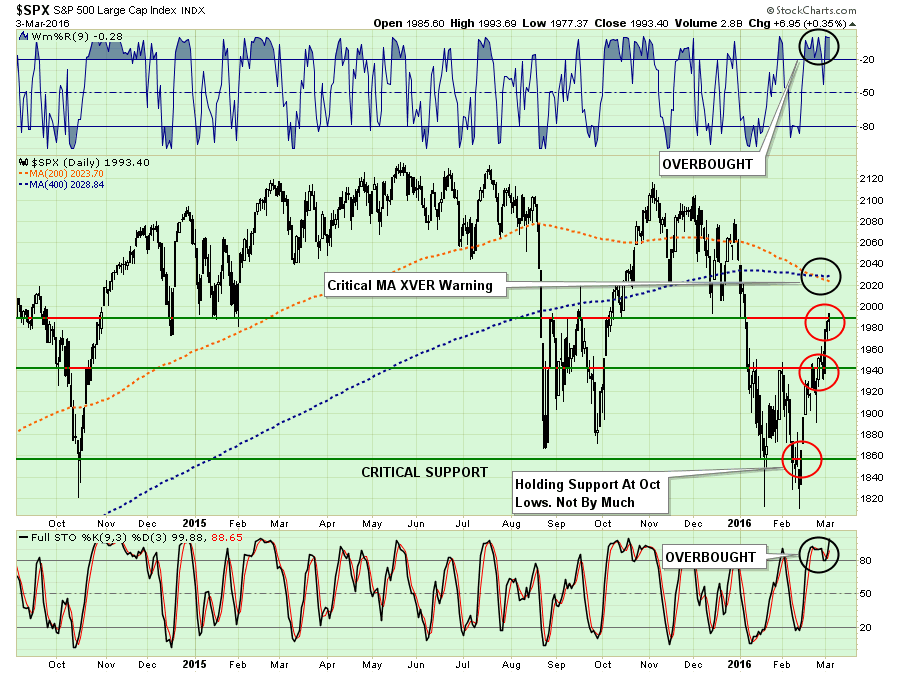

“The good news is that the market was able to break above 1940, and the 50-dma, which now clears the way for a push to the 1970-1990 where the next levels of resistance will be found.

The bad news is that the markets are once again extremely overbought and still confined inside of an overall downtrend.”

(Chart updated through Thursday close)

Is this rally, which looks a whole lot like other rallies we have seen repeatedly in recent months, a true return to a bull market? Or is this another trap being set by the bears?

While it is too early to know for sure, with risks still mounted to the downside a little extra caution might not be a bad idea.

This week’s reading list takes a look at various views on the market, economy and what to expect next. What is interesting is that being overly bullish at the moment carries more portfolio risk (loss of capital if you wrong) than being bearish (missing out on early gains).

1) This Is A Suckers Rally by Michael Kahn via Barron’s

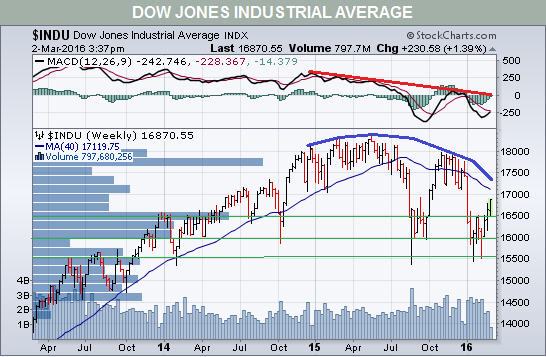

“Chip Anderson, president of StockCharts.com, wrote in a recent newsletter to users that current “emotional short-term reactions are really just part of a larger pattern.” According to his analysis, “The market has topped and is generally moving lower based on a rounding top pattern and the downward movement of the 40-week (200-day) moving average.“

But Also Read: Bears Have Their Backs Against The Wall by Avi Gilburt via MarketWatch

And Read: Top 10 Reasons Investors Should Sell Now by Doug Kass via Real Clear Markets

Leave A Comment