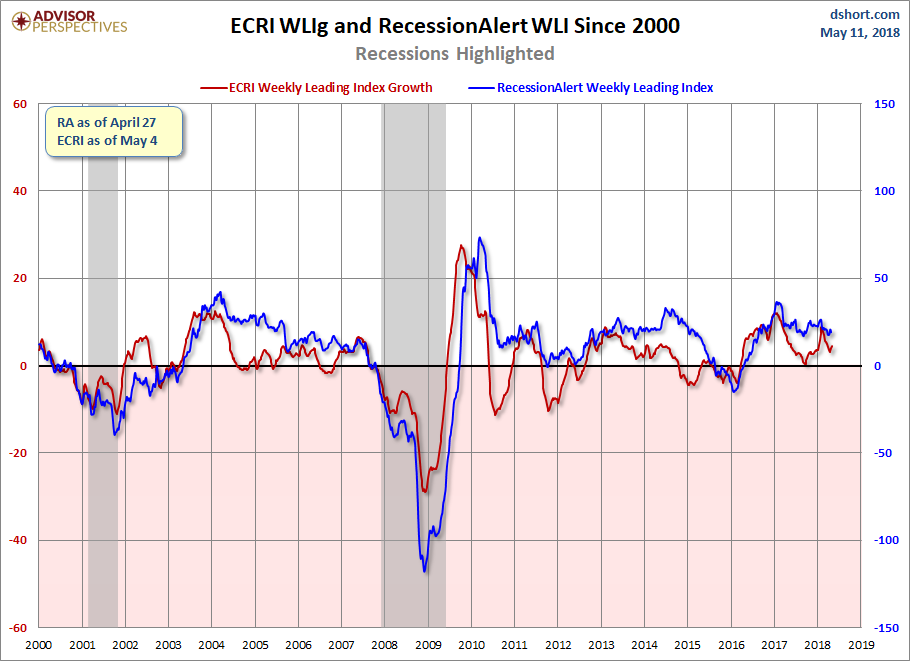

ECRI’s WLI Growth Index which forecasts economic growth six months forward remains in positive territory for over one year – after spending the previous 35 consecutive weeks in negative territory. This is compared to RecessionAlerts similar weekly leading index. Also ECRI released their inflation index.

Analyst Opinion of the trends of the weekly leading indices

Both ECRI’s and RecessionAlerts indicies are indicating moderate growth six months from today. Both indices are showing growth but the trends are in opposite directions. They are indicating conditions 6 months from today should be somewhat better than today.

Current ECRI WLI Level and Growth Index:

Here is this week’s update on ECRI’s Weekly Leading Index (note – a positive number indicates growth):

Comparison to RecessionAlert Weekly Indicator

RecessionAlert also produces a weekly foreward indicator using different pulse points tha ECRI’s WLI. Here is a graph from dshort.com which compares the two indices. These indices are now showing slightly different trends.

Coincident Index:

ECRI produces a monthly coincident index – a positive number shows economic expansion. The April index value (issued in May) shows the rate of economic growth improved.

z ecri_coin.png

ECRI produces a monthly inflation index – a positive number shows increasing inflation pressure. Inflation pressures are receding

Future Inflation Gauge Edges Up in June

U.S. inflationary pressures were up slightly in June, as the U.S. future inflation gauge grew to 111.6 from 111.3 in May, according to data released Friday morning by the Economic Cycle Research Institute.

“The USFIG edged up in June after having dropped noticeably in May,” ECRI Chief Operations Officer Lakshman Achuthan said in a release. “Thus, underlying inflation pressures, while still simmering, have come off the boil.”

Leave A Comment