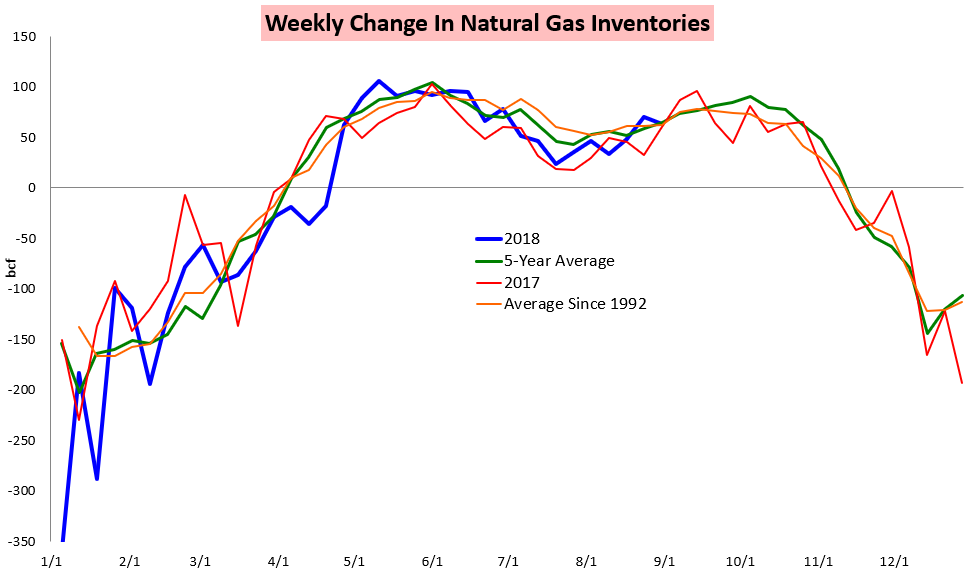

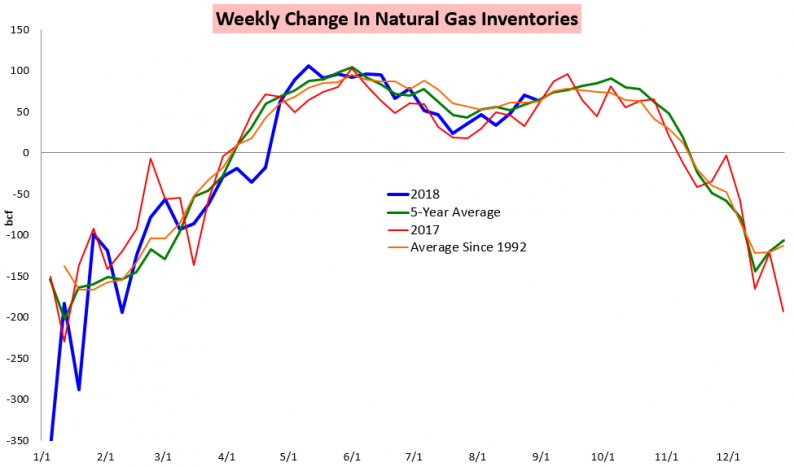

The Energy Information Administration announced that 63 bcf of natural gas was injected into storage this past week, coming in just 1 bcf below our 64 bcf estimate and slightly above the market consensus around 61 bcf.

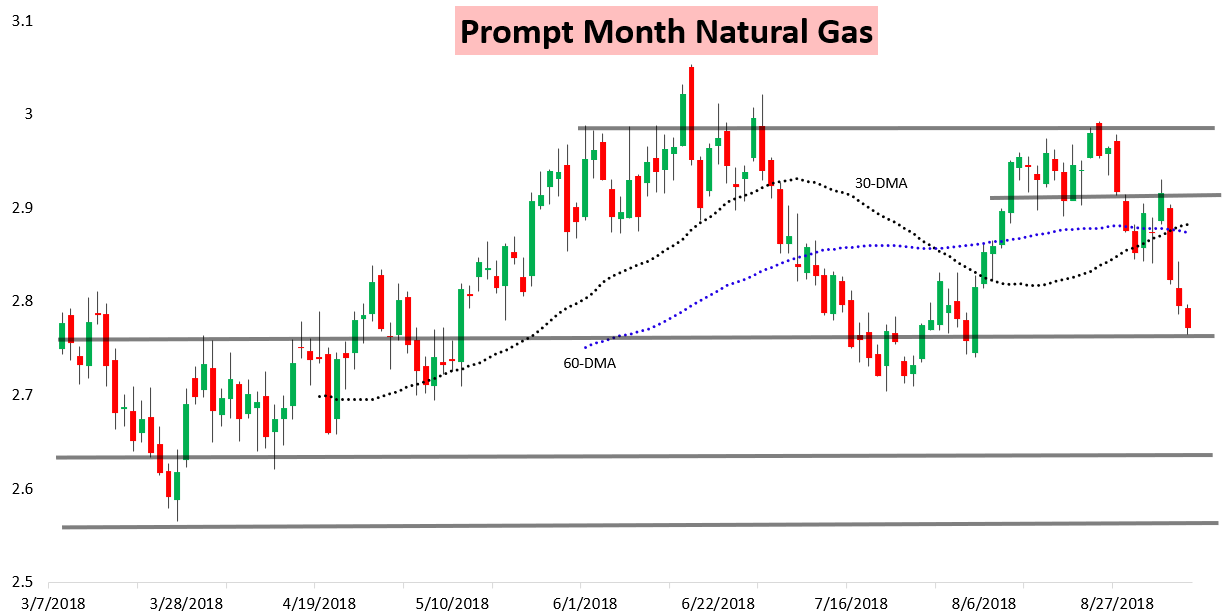

The result is that the prompt month October natural gas contract continued its grind lower today, with EIA data not providing much of a catalyst to bounce and confirming much of the recent balance loosening that the market has priced in.

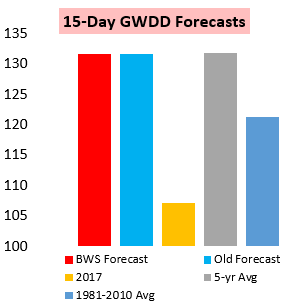

In our Morning Update we highlighted that, “…at +64 bcf we are a touch higher than the market consensus today as we see significant wind generation last week loosening power burns as Canadian imports and production both increased as well. Any print at or above our estimate would put $2.75 in play, though the test of that support likely holds as we are finally seeing power burns tighten up a bit at these lower price levels. Still, EIA data this week and next is loose enough that when combined with cool forecasts into early next week we should at least see another support test.”

With the print, a bcf below our injection estimate prices never did touch $2.75, but they came close, and our slightly bearish sentiment for the day verified well. This came with relatively minimal overnight GWDD changes as well.

Immediately after the print, as usual, we released our EIA Rapid Release for clients, putting the print in historical context by looking at how tight/ lose it is to last year and the 5-year average while also updating our weather-adjusted storage modeling and examining the expected price impact. This morning we outlined that the print was neutral and unlikely to have a major impact on prices today, while also being loose to most baselines.

We now head into the last trading day of the week having provided clients with the latest daily look at weather-adjusted demand and power burns in our Note of the Day as well as looking at weekly storage balances and seasonal storage expectations in our EIA Rapid Release and forward price and weather expectations in our Afternoon Update.

Leave A Comment