There is a consistent thread of discussion regarding the impending Fed rate hike and its impact on various markets, which are known to front-load the expected returns impact of the entire series of hikes in the first hike. Such forward expectations of relative value are common, as a change in interest rates impacts the expected returns not just in bonds, but any market that considers U.S. Treasuries as one barometer of return of “safe” assets. When return of safe assets rises, a value adjustment across the risk curve should be expected. What a higher U.S. interest rates does is increase returns expectations of “safe” investments, making them more attractive relative to risky alternatives, and thus change the expectation of acceptable returns. At times this can get overdone, or mis-analyzed, which is where a recent Source Multi-asset research piece comes in play.

Click on picture to enlarge

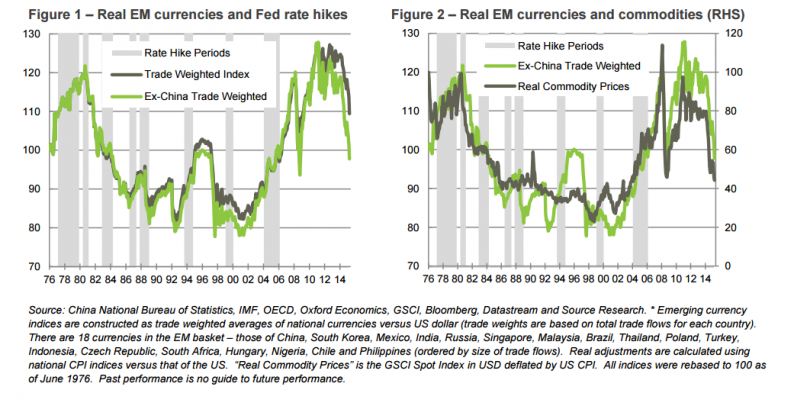

U.S. Fed tightening being considered as reason for sinking emerging market currency values

The recent sharp decline this month of emerging market currencies is being attributed to a significant degree to the forthcoming potential for Fed tightening. But this rational is not the only issue at play, report authors Paul Jackson and Andras Vig observe. To understand the real issues in emerging markets, investors should look past the shiny gloss of a Fed rate hike explanation and instead focus on commodities.

Emerging markets with perpetual exposure to commodities have sinking currencies. Those nations with lighter commodity exposure, when isolated from the emerging market currency pact, have not experienced the same degree of a drop. In other words: don’t make a blanket statement that the drop in emerging market currencies is due to an impending U.S. rate rise. Compare traditional emerging market currencies such as Brazil, for instance, which is currently down to 12 year lows for a variety of reasons, with emerging markets such as the Czech Republic, without the same degree of commodity production dependency and one sees a difference. Most commodity dependent emerging market currencies are failing badly, while those rare emerging markets not dependent on commodities in a significant way are prospering.

Leave A Comment