Posted By: Rupert Hargreaves

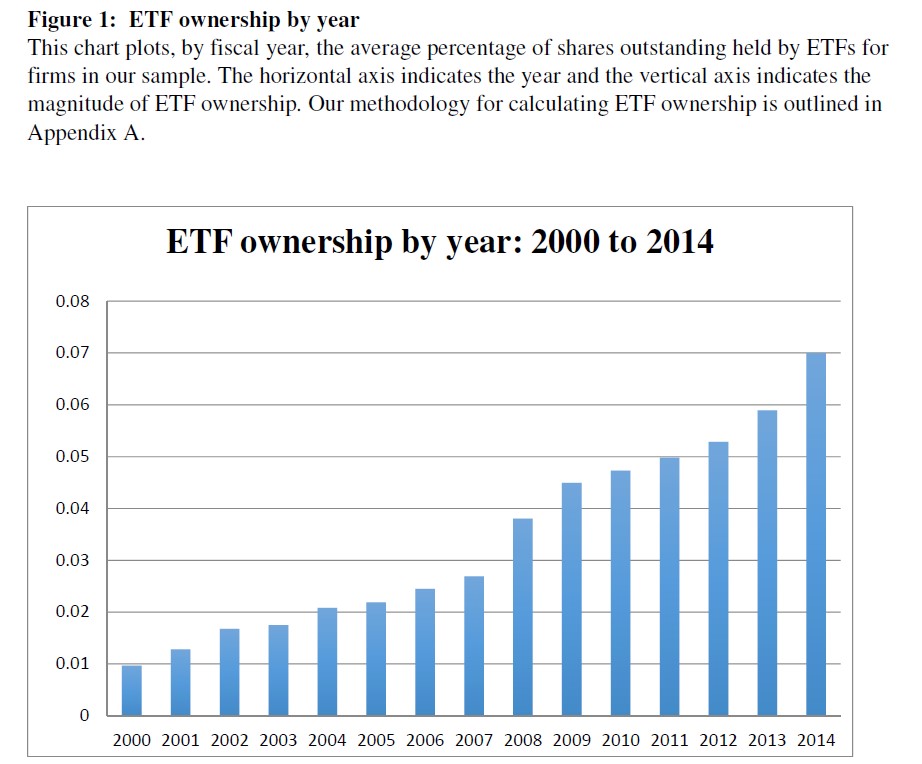

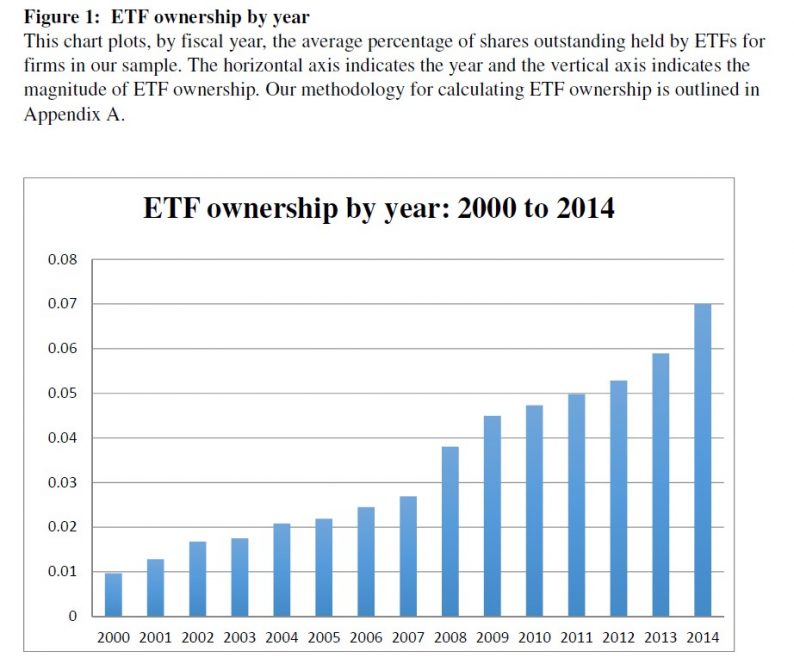

The rapid rise of the ETF industry over the past two decades has been nothing short of astounding. Since the launch of the SPDR S&P 500 ETF (SPY) during 1993, more than 1,600 ETFs have hit the market, covering a broad range of assets and strategies.

The value of assets being managed by the ETF industry has expanded nearly 2,000% since 2001, eclipsing the growth of the mutual fund industry over the same period (+120% AUM). That said, the size of the ETF industry is still relatively small compared to the mutual fund industry. Mutual funds manage a combined $15.9 trillion of assets, compared to ETFs $2.9 trillion of AUM.

But the complexity of the exchange-traded product market seems to be holding the industry back from expanding further. According to a survey conducted by etfdb.com when quizzed as to why they didn’t use ETPs, around half of the advisors questioned stated that they didn’t know enough about the products to recommend them to clients. Recent ETP market developments are likely to have only increased this sentiment.

ETFs: Growing asset class

ETF’s: Separating fact and fiction

At the end of August, Bank of New York Mellon revealed that it had been unable to produce correctly ETF and mutual fund valuations due to a computer glitch that occurred during the market turmoil at the end of last month.

The issue affected 20 mutual fund firms and 26 families of ETFs, which together account for about 10% of US funds (not all used the damaged system). The PowerShares China ETF was one of the most affected instruments; its published a net asset value that was off by 2.5%.

BNY Mellon’s ETF debacle highlighted the risks of ETFs, or more specifically, the danger of relying on an often misleading underlying NAV to value ETFs.

Even ETF has a custodian, which holds all the assets of the fund and records any liabilities. And while the custodian holds the assets, it’s the job of the fund accountant to keep track of expenses, the fund’s NAV and dividends received. Many custodians do the accounting themselves using proprietary software and dedicated employees. Some outsource it or use third-party software vendors.

Leave A Comment