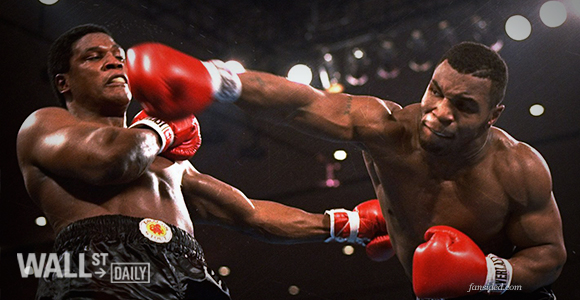

Mike Tyson once said, “Everyone has a plan until they get punched in the mouth.”

Now, we may not be climbing into the ring with a professional boxer anytime soon, but the financial markets we tangle with on a daily basis also have an uncanny ability to surprise, inflict pain, and otherwise ruin our best-laid plans.

The stock market decline in late August is a perfect example.

A wave of selling pressure culminated in a flash crash on August 24. Many traders and investors simply couldn’t withstand the pain and sold into the panic.

However, those who were prepared were far better able to withstand the barrage – and having a healthy allocation of volatility-dampening fixed-income securities has certainly helped.

For instance, the Vanguard GNMA Fund (VFIIX) I profiled in June 2014 has produced a nice and steady 3.8% total return since then. Meanwhile, the SPDR S&P Dividend ETF (SDY) has limped to a 0.3% total return with erratic ups and downs.

Once again, dividend stocks aren’t bond substitutes. Besides being properly diversified, your plan may also involve gradually reducing your fixed-income allocation and increasing your equity exposure during times of market stress.

The question then becomes what stocks to buy.

Focus on Cash Flow

Investors should look for stocks that have become inexpensive, but still have strong underlying businesses generating healthy free cash flow (FCF).

Corning Inc. (GLW), a specialty glass maker, and The Mosaic Company (MOS), which produces crop nutrients such as potash, are two prime examples.

These stocks have respectable dividend yields above 2.5%. Plus, dividend payout increases and share buyback activity are indicative of management’s confidence in ongoing FCF generation – and both stocks’ total yields (dividend yield plus net share buybacks) are well above average.

Of course, we want to make sure that these buybacks are being conducted at low valuations and that the firms aren’t becoming overly levered in order to distribute cash to shareholders.

Leave A Comment