On the morning of the 22nd of February, the EURUSD pair is continuing its slow decline and is trading at 1.2275 at the time of writing, marking a 39-pip drop over the last 24 hours.

In my view, there are several key factors responsible for the EURUSD pair’s decline over the last 24 hours. First of all, according to yesterday’s economic report on the Eurozone from IHS Markit, GDP is now expected to grow by 3.5% – 3.6% year-on-year in the first quarter of 2018 in contrast to the 4% projected last month. As such, the euro is correcting due to the fact that GDP growth forecasts for the Eurozone have been revised downwards. The second factor is that yesterday’s IHS Markit report on the USA revised its GDP projections for the first quarter of 2018 significantly upwards from January’s. GDP is now expected to rise by nearly 3% in the first quarter of this year, whereas it was previously projected to be somewhere between 1.9% and 2.2%. Thirdly, the FOMC minutes (from their January meeting) published yesterday at 22:00 (GMT+3) didn’t provide any surprises; the Fed maintains that it will continue to gradually tighten its monetary policy as the as the US economy continues its recovery.

Given the significantly improved forecast for the US economy, the reduced economic growth forecast for the Eurozone, and the lack of surprises from the US Fed, I think there’s a high chance of the EURUSD pair continuing to decline.

Today, I advise paying attention to the minutes of the ECB’s latest meeting on monetary policy, which will be published at 15:30 (GMT+3).

EURUSD

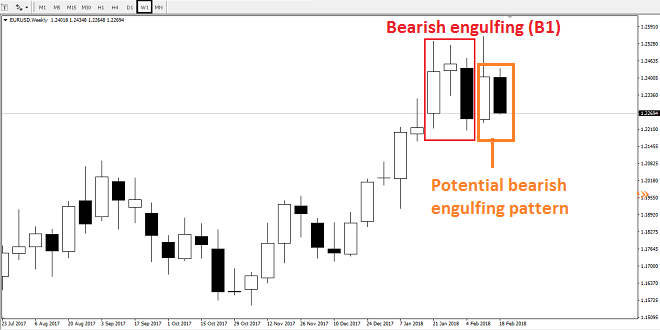

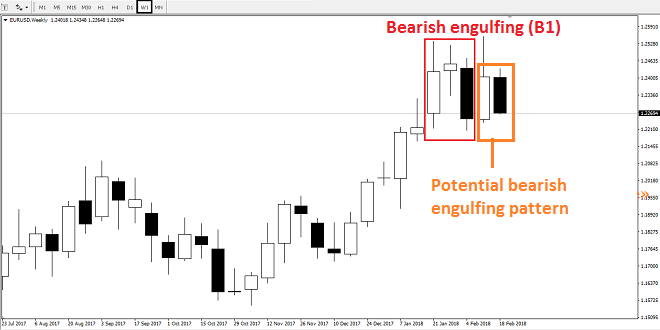

On the weekly timeframe (W1), the EURUSD pair is trying to form another bearish engulfing pattern:

In my opinion, if the bearish engulfing pattern completes its formation by the end of the week, it would be a very strong signal that a top is being formed on the EURUSD pair considering that another bearish engulfing pattern was formed last week (B1 on the chart).

Leave A Comment