Previous:

On Friday the 2nd of November, trading on the EURUSD closed down. After the publication of the US labor market data buyers lost all their daily gains. The number of new jobs exceeded expectations, and the value for the previous month has been revised upwards. The index of average hourly earnings (YoY) reached a 9-year high. Unemployment in the US remains at 3.7%.

US factory orders and the growth of US 10-year bond yields, which rose to 3.22%, served as good news to sellers.

The euro fell to 1.1372 on expectations of another rate hike in December. According to the latest data by CME Group’s FedWatch, the likelihood of a rate hike in the US in December is 77.5%. Before the payrolls data was published this amounted to 74.5%.

US data:

Day’s news (GMT+3):

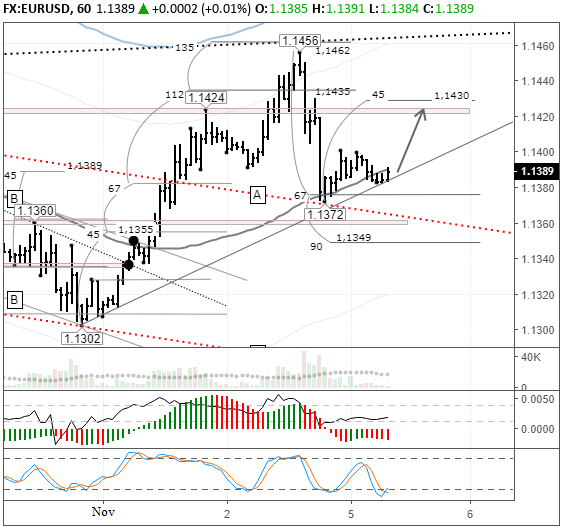

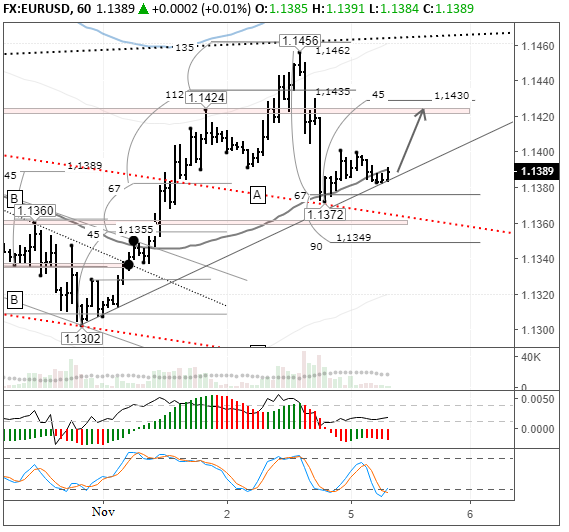

Fig 1. EURUSD hourly chart

Current situation:

The euro crashed by 67 degrees to 1.1456. This is approximately 50% of the upwards movement from 1.1302 to 1.1456. The labor market report has come out. You can forget about it for the month. You can even forget that it came out of Friday, and the price fell 70 pips on this news.

The 67th degree and the balance line acted as a support. At the time of writing, the euro is at 1.1390. Given that there is not much in terms of news going on in Europe at the moment, on Monday, I am waiting for the price to recover to 1.1422.

Leave A Comment