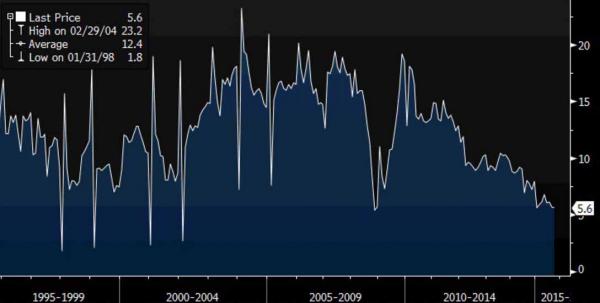

For the third day in a row, China dominated the overnight newsflow with the latest industrial output data, which printed at 5.6% missing expectations of a 5.8% increase, and was tied with March for the lowest print since late 2008.

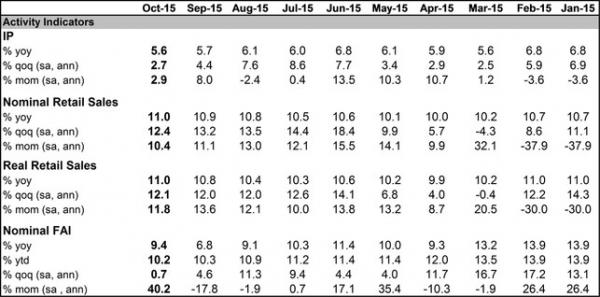

The detailed breakdown:

Additionally, electricity output dropped 3.2% on year, the second straight decline, underscoring the impact of the domestic slowdown on heavy industry. Steel and cement output continued to decline. Investment in property development slowed to a 2% pace of growth, the lowest since early 2009 in the depths of the global financial crisis. While housing sales are rising, data suggest most of that is accounted for by developers clearing inventory rather than building new properties.

The continued industrial weakness in turn pushed the commodity complex lower, with both copper…

… and the entire universe continuing its recent decline as copper, zinc and nickel are heading for their lowest close in at least six years as slowing growth in China dents demand from the world’s largest consumer of energy, metals and grains. The London Metal Exchange index of six industrial metals is set for a third consecutive annual drop, the worst streak since at least 2001. The gauge has sunk 23 percent this year and 50% from its 2011 highs.

And while China’s fixed investment, commodity-reliant economy, which accounts for about half of the country’s GDP, it was a glimmer of good news surrounding China’s consumer economy that, together with the plunge protection team pushed stocks into the green in a last hour scramble, when October retail sales were reported a better than expected +11.0% yoy (vs. +10.9% expected), which was up one-tenth from September and the highest annual increase in 9 months. Additionally, vehicle sales jumped 7.1% y/y in October, up from 2.7% in September, and vehicle production turned positive, up 4.9%, for the first time in four months thanks to recent government stimulus meant to boost the local car industry.

“The retail sales data were a positive boost to sentiment,” said Ronald Wan, chief executive at Partners Capital International in Hong Kong. “Targeted measures as well as the holiday effect helped with consumption last month. A transition towards consumer-driven economy is taking place, albeit at a slow pace.”

The retail data also came during China’s ‘Singles Day’, a day which initially started during the 1990s by college students in something of a twist on Valentine’s Day and which has now progressed into a mega-day for retail sales in China. In fact, Alibaba has estimated that 1.7m deliverymen, 400,000 vehicles and 200 airplanes will need to be deployed to handle today’s deliveries. The same company announced this morning that it sold some $5bn worth of merchandise in just the first hour and a half of the day. So if you’re one of those that has been stunned at how ‘Black Friday’ has moved from a quaint US event to what is fast becoming a global behemoth then be warned as the marketing men have ‘Singles Day’ as their next plan for global domination.

Ultimately the market decided to focus on the retail sales and to ignore the ongoing collapse in the commodity complex which overnight also led to the latest Chinese default, this time a cement maker China Shanshui Cement Group Ltd, leading to the following markets picture:

Market Wrap

Elsewhere in Asia, markets traded mixed following the lacklustre close on Wall St., and unlike China itself, focused on the further weak tier 1 data from China adding to the cautious tone in the region. As noted above, the Shanghai Comp. (+0.3%) traded lower after the headline Chinese industrial production data missed expectations before recovering as participants continue to speculate over further PBoC easing, while the Hang Seng (-0.2%) pulled off worst levels following Tencent earnings. ASX 200 (+0.5%) was underpinned by broad sector gains offsetting the weakness in materials amid concerns surrounding BHP (-2.9 %). Nikkei 225 (+0.1%) traded flat amid light volumes coupled with USD/JPY softening. 10yr JGBs traded lower in a subdued session, while the BoJ entered the market to purchase JPY 1.2trl in government bonds.

Leave A Comment