The US stock market has had a rough ride over the last three months. But if you averted your eyes from the volatility that started after Aug. 18 and checked the S&P 500 (SPY) as of yesterday’s close (Nov. 10) it appeared that nothing much had changed. The fractional loss looks uneventful and so one might wonder what all the fuss was about? There’s been an enormous amount of churning in the market since mid-August, but for the moment the dust has settled and from the perspective of the S&P 500 we’re right back where we started.

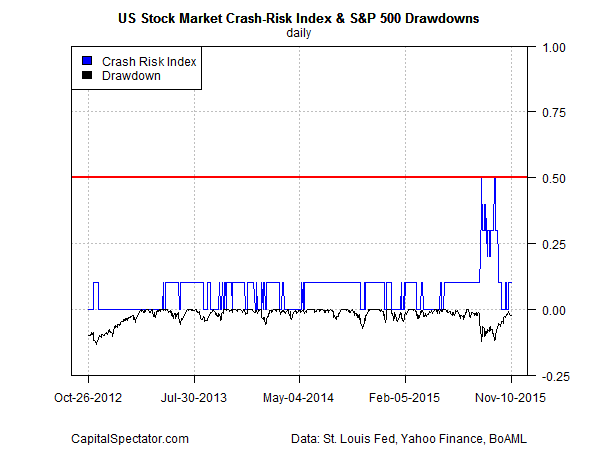

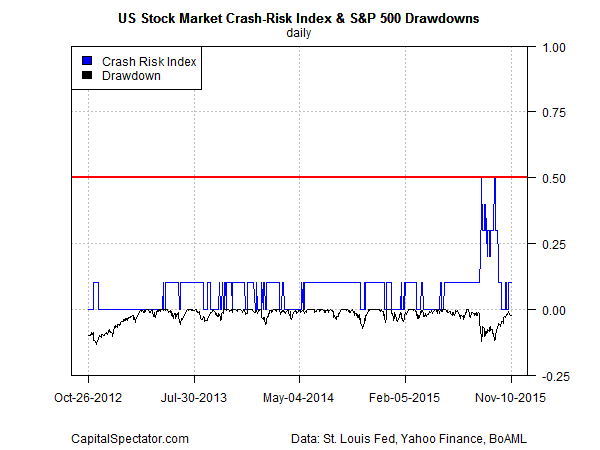

Equity performance has essentially been flat since mid-August, raising the obvious question: Has the danger passed? For the moment, yes. In fact, my 10-factor US Stock Market Crash Risk Index (CRI) has receded into a non-threatening posture after a brief but borderline flirtation with an all-out sell signal on a few days in August and September, as the chart below reminds.

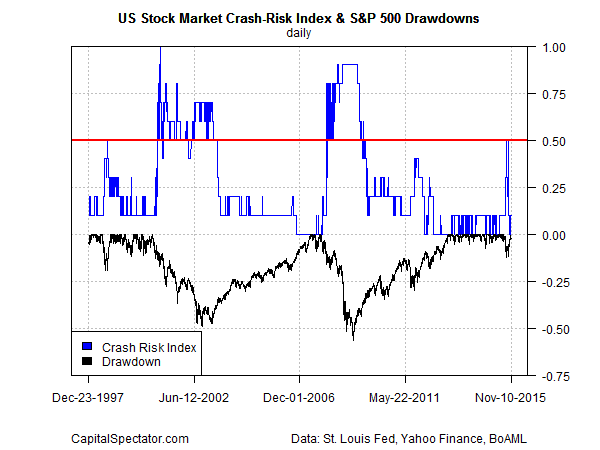

For some historical perspective, here’s how CRI stacks up since 1997:

Note that despite the recent period of turbulence this multi-factor measure of stock market risk never ventured above the 0.5 mark, which would have been an ominous sign. The tipping point was briefly reached on a handful of days—once in August and for two straight days in late-September, when CRI touched 0.50. It was tempting at the time to assume the worst and run for the hills. But the inability of CRI to rise decisively above the 0.5 mark (or even remain at that midway point for more than a day or two) left room for doubt that the end-of-the-world call from some corners was the genuine article.

The message is that the market suffers periods of elevated risk from time to time–periods that can but rarely turn into sustained bear market and economic recession. Recognizing the difference in real time isn’t easy, but we can and should make informed estimates by intelligently reviewing the numbers.

Recall that on Sep. 24, just days before CRI would make its second run up to 0.5, I considered what might constitute a clear signal that it was time to embrace a full-blown risk-off posture. The reluctance of CRI to rise decisively above 0.5 offered a degree of comfort. But if the bull market was truly over, the case would be clear via a deteriorating US economy. As I wrote at the time:

Leave A Comment