Markets were thrown for a loop in the past 24 hours, with the Dow first soaring nearly 400 points on Thursday on expectations that tax reform was a done deal, when drama emerged just after the close when the Senate tax bill came this close to falling apart when the proposed “Trigger” was ruled as invalid, pushing a Thursday tax vote to this morning, and as of this moment the bill appears in limbo with the GOP scrambling to find ways to appease the sudden loud opposition among budget hawks. UBS economist Paul Donovan summarized it best this morning:

Tax cut plans were thrown into confusion by the realisation that the US Treasury Secretary repeating “tax cuts pay for themselves” does not, in fact, make it true. A tax increase trigger mechanism was also ruled out. Votes will take place today to attempt to strike a new compromise. Faced with this crisis, US President Trump has responded with swift and decisive leadership by publically saying “Merry Christmas”. Like every other president has done.

On Friday morning, Trump continued the pep talk…

Republicans Senators are working hard to pass the biggest Tax Cuts in the history of our Country. The Bill is getting better and better. This is a once in a generation chance. Obstructionist Dems trying to block because they think it is too good and will not be given the credit!

— Donald J. Trump (@realDonaldTrump) December 1, 2017

… but this time the market wasn’t falling for it, and overnight both US futures and global equity markets are notably lower on concerns over what the latest fireworks in the Senate tax bill mean.

For those who missed it, here’s what happened: as reported last night, the Senate postponed a vote on the GOP tax bill on Thursday night with the debate to continue on Friday, in which US Senate Majority leader McConnell stated that the next floor votes will be 1100EST. in related news, US Senator Mike Rounds said the Senate is to adopt a USD 10K state-local tax deduction and Senator Cornyn said other trigger ideas are being vetted for tax reforms, while Senator Corker stated the bill is to include USD 350bln in tax increases. In other words, the tax cut somehow is now a tax hike.

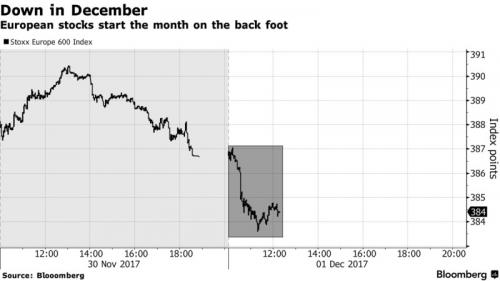

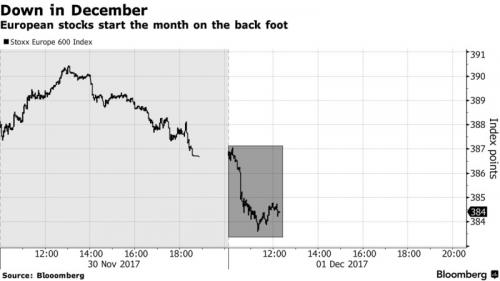

As a result, first Asian, then European stocks dropped at the start of the last month of 2017 as the tech stock sell-off resumed. The dollar was pressured by tax confusion, and Treasuries predictably gained.

The Stoxx Europe 600 Index fell to a two-week low, with all but one of the 19 industry sectors turning red. The price action in Europe began with DAX tripping through the 13k level and yesterday’s low, while the November low resides at 12,847. In tandem with this, auto names had been leading the losses with Fiat Chrysler shares halted for trade, having fallen 5%. Tech stocks stumbled sharply for a third day, bringing their decline this week to almost 5%. The SX8P index was down 1.7% vs Stoxx 600’s 0.8% decline; the tech subindex extends this week’s decline to as much as 5.2%. Among the worst performers: Infineon -4.2%, Software AG -3.5%, STMicro -3.2%, Logitech -2.2%, SAP -1.9%, ASML -1.8%.

Sentiment in Asian markets was also subdued and Japanese stocks briefly gave up all their gains amid a pullback in USD/JPY, a miss on Chinese PMI data and after the Senate postponed a tax reform vote to Friday morning. Shanghai Comp. (Unch.) and Hang Seng (-0.4%) were indecisive in the wake the aforementioned data and after the PBoC skipped operations due to high liquidity, with Tencent also jittery following its fall out from the USD 500bln club. The Hang Seng Index fell 0.4% Friday, and down 2.7% on the week, to close out its worst week since December last year, with Tencent Holdings Ltd. and Ping An Insurance among the main drags on the benchmark. China large caps also have worst week of 2017, with CSI 300 Index declining 2.6%. Shenzhen Composite Index adds 0.8% Friday. Tencent tumbled 3.3% for weekly loss of 7.4%, though the stock is still a top performer this year, with 103% gain.

The MSCI World Index slid 0.2%. Japan’s Nikkei had finished 0.4% higher, while MSCI’s broadest index of Asia-Pacific shares outside Japan was nearly flat on the day.

The dollar pared its weekly gains as U.S. tax overhaul stalled and Treasuries advanced; the euro met renewed demand from leveraged accounts and the loonie rose before the release of Canadian growth and labor data; the pound slipped below $1.35 as the Irish border question remained unanswered; core euro-area government bonds edged higher, while the S&P futures index fell, suggesting U.S. stocks will track European equities’ weakness. Chinese bonds posted their first weekly gain since mid-September.

There was one outlier in overnight FX: the pound was on track for its best week since mid-October even as the Brexit breakthrough that boosted the currency this week appeared to be at risk. Sterling has gained since Tuesday on hopes U.K. Prime Minister Theresa May and her European counterparts will agree to move Brexit talks on to trade at a Dec. 4 meeting, although the Irish border issue threatens to be a roadblock. The currency, which was also boosted by month-end dollar selling, could take direction from Friday’s manufacturing data for November, expected to come in stronger than the previous month.”Any sterling gains we may see on a beat on manufacturing PMI should be sold into as it makes sense to take profit on any gains into the weekend” CIBC’s head of G-10 FX strategy Jeremy Stretch said in emailed comments

U.S. stock-index futures also declined. 10Y TSY yields dropped back below 2.4%, down 2bps – the largest dip in more than a week – after climbing eight basis points in the previous two days. The euro pared an advance even after manufacturing data underscored the region’s economic resilience. The latest Markit PMI showed Euro zone factories had their busiest month for over 17 years in November. Of course, ISM and PMIs are nothing but “fake news” as UBS also explained:

Assorted manufacturing sentiment opinion polls are due out. 1) This is not the real world, and calling a rising PMI or ISM “stronger output” is fake news. 2) People lie on surveys, answer questions inaccurately, or answer a different question to the one asked. 3) This is why the correlation of sentiment surveys with economic reality is so low.

“We have a two-faced market. Wall Street continues to run on hopes of fiscal reform while in Europe, the renewed strength of the euro is hurting the DAX which in turn is dragging all the other bourses to the downside,” said Carlo Alberto De Casa, Chief Market Analyst at ActivTrades.

Leave A Comment