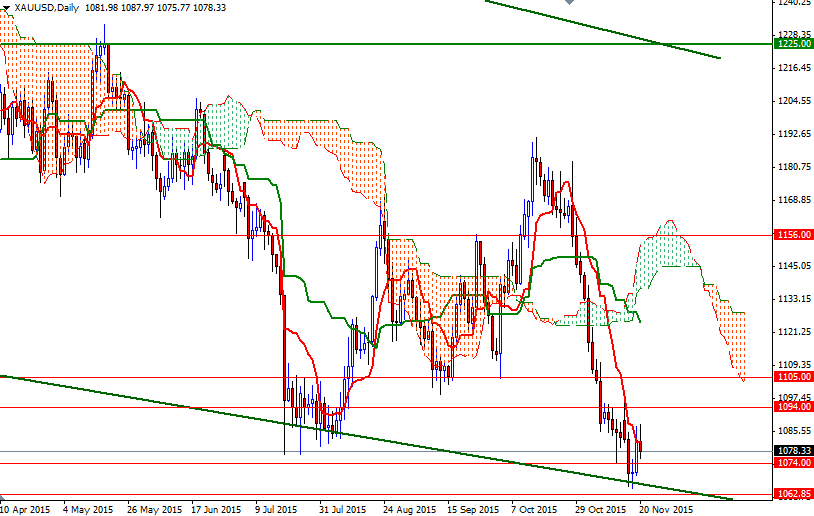

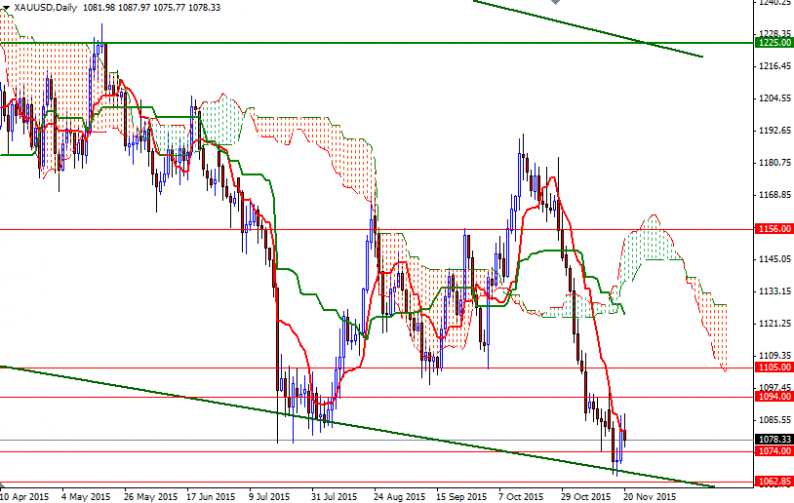

Gold prices settled at $1078.33 per ounce, falling nearly 1% over the course of the week, as the metal struggled against a stronger dollar driven by the increasing likelihood of an interest rate hike next month. The market opened higher on safe-haven concerns after the horrible Paris attacks but investors’ risk aversion faded over the course of the first trading day and eventually the XAU/USD tested the lower trend-line support of the descending channel passing just above the 1082.65 level. With the help of this support, the market was able to return to the 1089/7 resistance strengthened by the 4-hourly Ichimoku cloud.

It appears that Fed officials are determined to begin a new policy phase if upcoming economic data justifies them. Minutes from the Fed’s October meeting showed most policy makers anticipate that conditions to raise rates could well be met by the time of the next meeting, while a “number” of participants say delaying hikes could increase uncertainty in financial markets. However, they also stress that the subsequent path of increases is likely to be exceptionally shallow and gradual, meaning that they are going to take their time in raising rates further. Friday’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 34399 contracts (the lowest level in fourteen weeks), from 68389 a week earlier.

With these in mind, I think it is possible to see the market staying within a range of 1105 to 1062.85 in the coming days. If gold prices manage to hold above the 1076/4 region where the bottom of the hourly Ichimoku cloud sits, there is a chance the market will retest the 1089/7 zone. A break up above 1089 would suggest that the bulls will be aiming for 1094, or even 1098. On the other hand, if the bears can maintain control and shatter the 1076/4 support successfully, XAU/USD may test 1066 and 1062.85/1.55. A strong break below this critical area might lead to a drop towards 1054.

Leave A Comment