Fundamental Forecast for Gold: Neutral

Gold prices charged higher this week, recovering all the losses sustained in the previous session with the yellow metal rallying 2.3% to trade at 1219 ahead of the New York close on Friday. The advance into near-three month highs has been supported by continued softness in the greenback with the DXY down another 0.66% this week to mark its 6th consecutive weekly loss.

Non-Farm Payrolls released on Friday showed the U.S. economy added 227K jobs for the month of January, far surpassing expectations for a print of 180K. While the headline unemployment rate did uptick to 4.8%, it was accompanied by a 0.2% uptick in Labor Force Participation (which is a good thing). Still, slower wage-growth figures are likely to encourage a continued wait-and-see approach from the FOMC. Fed Fund Futures remain well rooted with expectations for a June rate-hike currently priced at just under 70% (roughly the same as last week). So, what does all this mean for gold? As long as the outlook for interest rates remains stable, the downside is likely to remain limited for bullion in the medium-term, especially as boarder equity markets continue to probe into new record highs. That said, gold prices are closing the week just below technical resistance and leave the constructive outlook at risk into the February open.

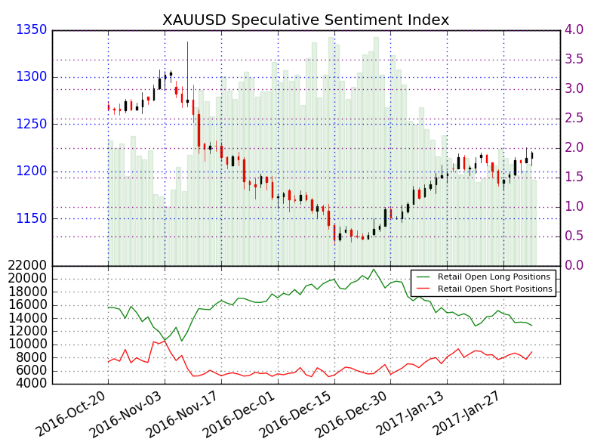

A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long Gold- the ratio stands at +1.48 (60% of traders are long). Long positions are 15.2% below levels seen last week while short positions are up 14.2% over the same period. It’s worth noting that although the narrowing from net-long positioning is seen as constructive, the move has been accompanied by lackluster market participation with open interest 8.7% below its monthly average. That said, the ratio being at more neutral levels here further highlights the risk of a near-term pullback in price and I would be looking for a flip to net-short in the days ahead to validate a more aggressive long-bias.

Leave A Comment