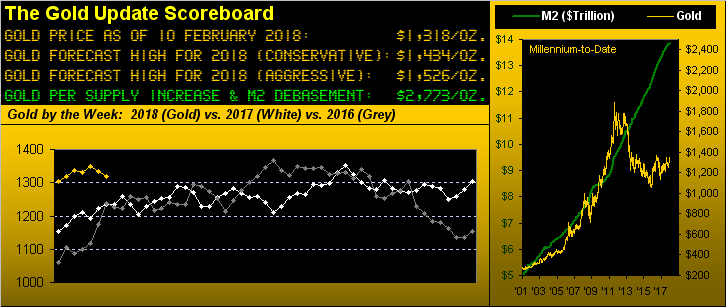

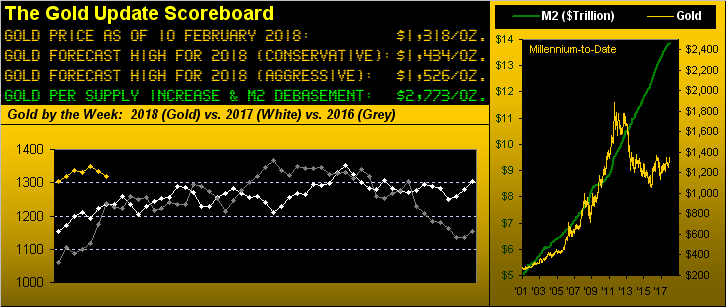

Financially, February is not a month over which there is much fuss. For gold, February is generally quite neutral: of the 43 Februaries from 1975 through 2017, Gold has finished up 22 times and down 21 times for a median net gain of 0.1%/February.

What about for the stock market? For the 48 Februaries from 1970 through 2017, the S&P 500 has finished up 28 times and down 20 times for a median gain of 0.9%/February. But, uh-oh, what just happened?

There’s no love for the S&P this February. It’s down -7.2% thus far this month, and -8.8% from our proclaiming two weeks ago the S&P’s “Blow-Off Top”. And it gets worse, for there are two other Februaries with which the S&P may now be keeping company that are more daunting. This February may be far from over, but from our purview, neither is the selling. Only two other Februaries negatively rival this one: that of 2001 in the midst of the “Dot Com Crash”, the S&P finishing February -9.2%; and in 2009 during the final fallout of the “Black Swan Smash”, the S&P closing out that February -11.0%. And what do we remember about the full top-to-bottom culmination of those two events? Both resulted in “corrections” of worse than -50%.

So: do we see this correction as becoming that bad? To be sure, per our 30-year chart of the S&P presented in last week’s missive, there is no material structural support for the S&P (presently 2620) until it reaches the 2200-2000 zone. And call it what you will: “The Interest Rate Scare Affair”, or as been our pending preference now for years, the squirming over “Look Ma! No Earnings!”, the S&P appears destined to put in a full 25% correction as we depicted a week ago down to 2154. Whether that occurs in full this month, or “conveniently” right up to November’s mid-term elections, that’s our S&P downside target.

But before the baby gets thrown out with the bath water and “they” try to gun it still farther down for a 50% correction “just because”, let’s do some math:

Leave A Comment