Gold prices ended Wednesday’s session down $15.92, to settle at $1053.44 an ounce, pressured by the dollar’s rally after hawkish comments Federal Reserve Chair Janet Yellen backed the case for a lift-off in rates before the end of the year. Yellen said “When the Committee begins to normalize the stance of policy, doing so will be a testament … to how far our economy has come. In that sense, it is a day that I expect we all are looking forward to.” Yellen is due to testify on the economic outlook before a joint Congressional committee today. The greenback was also supported by stronger-than-expected employment data. The Automatic Data Processing Research Institute said companies added 217K employees in November.

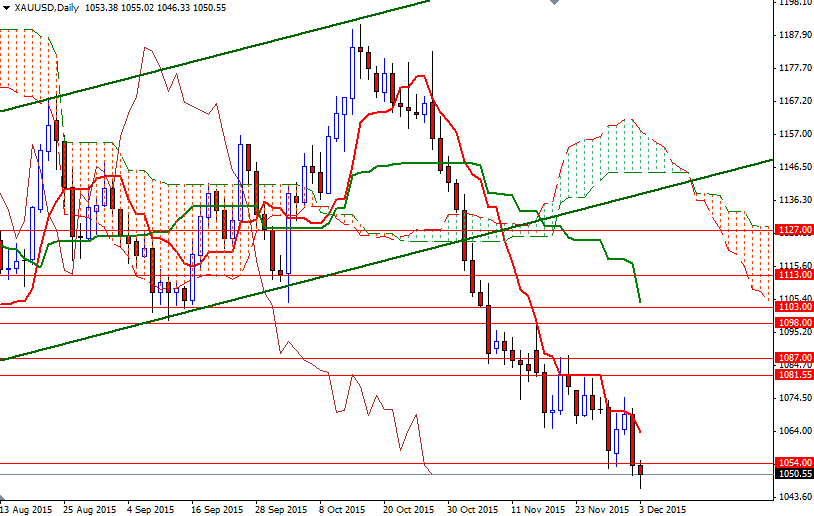

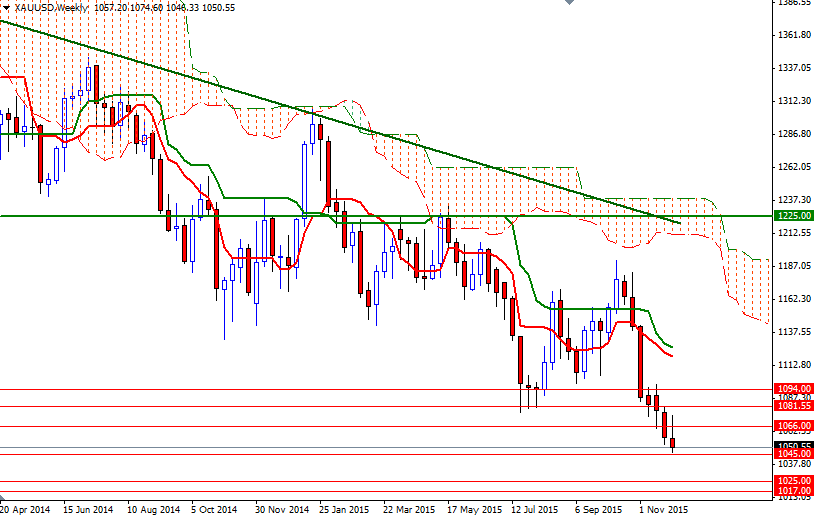

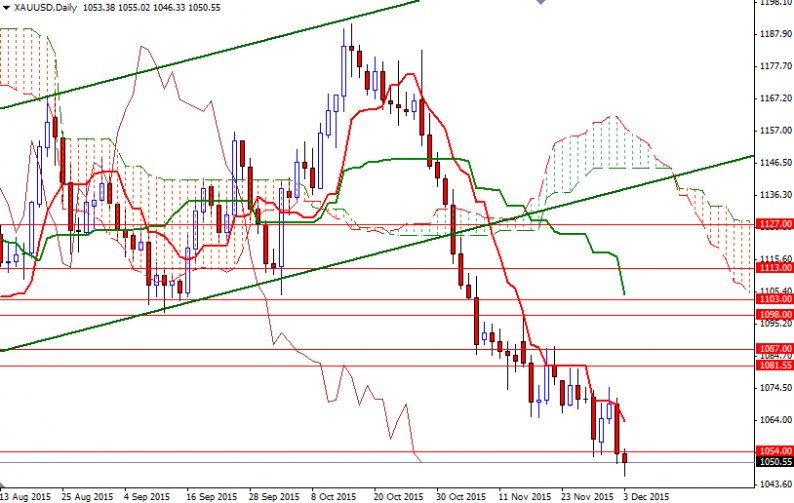

The XAU/USD pair dipped to as low as 1046.33 earlier in the Asian session but found some support above the 1045 area and bounced to the 1050.55 level. I have been pretty bearish since prices broke below the ascending channel (shown on the daily chart) and telling that -based on the measurement- we will probably grind lower towards 1045. So at this point, I would advise a bit of caution. As pointed out in recent analysis, breaching the 1045/ support is essential for a bearish continuation targeting the 1025/17 area. On its way down, some support can be seen at 1036.

On the other hand, if XAU/USD struggles to drop through 1045, we might return the previous support now flipped to resistance at 1054. Beyond that, the bears will be waiting in the 1061.41 – 1058 region marked by the 4-hourly Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines. The bulls have to push through 1061.41 so that they can revisit 1066/5 (the botom of the Ichimoku cloud on the 4-hour chart).

Leave A Comment