I’ve suggested that investors may need to look beyond the head and shoulders top formations that recently appeared on bullion and many precious metal stocks.

Intermediate uptrends often consist of three legs. In 2017, gold has had two legs up.

The next US jobs report is scheduled for release on Friday. Will it be the catalyst that launches the third leg higher for gold? I’m not sure, but I am sure of what’s important for gold, which is that it is generally very well supported here, both technically and fundamentally.

The bottom line: Gold held in ETFs is quite steady. China’s economy has softened, but only modestly. That light softness is almost certainly related to the government’s action taken to reduce pollution.

Chinese mine production has fallen as excessively polluting operations have been shut down. That’s adding support to the gold price.

In India, the economic growth has slowed more noticeably than in China, and that does have an effect on gold demand. This growth slowdown has been mitigated by a rise in the rupee against the dollar, which lowers the cost of gold for Indians.

Along with commercial traders on the LBMA and the COMEX (aka “the banksters”), Indian buyers are the most eager buyers when the gold price drops.

The US Treasury wants India’s central bank to reduce its purchases of US dollars.

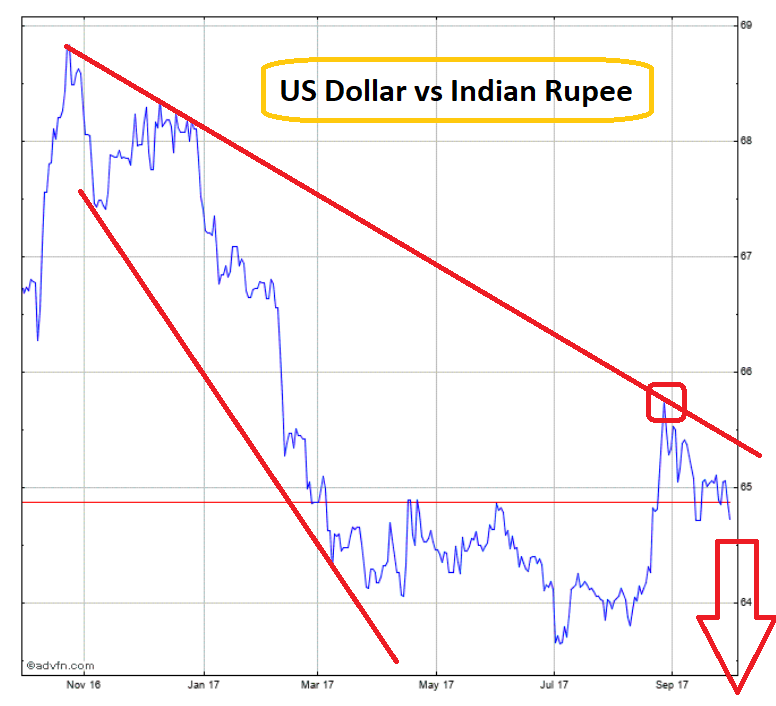

As India recovers from the disastrous demonetization program that pounded the nation’s GDP growth, the dollar could enter the “meat and potatoes” zone in a major bear market against the rupee.

That would put gold on sale in a major way for Indians, and demand could surge.

The dollar looks like a train wreck against the rupee on this one year chart, and that happened with the Indian central bank buying the dollar aggressively!

What happens if US government pressure works, and the Indian central bank pares back its dollar buying?

Leave A Comment