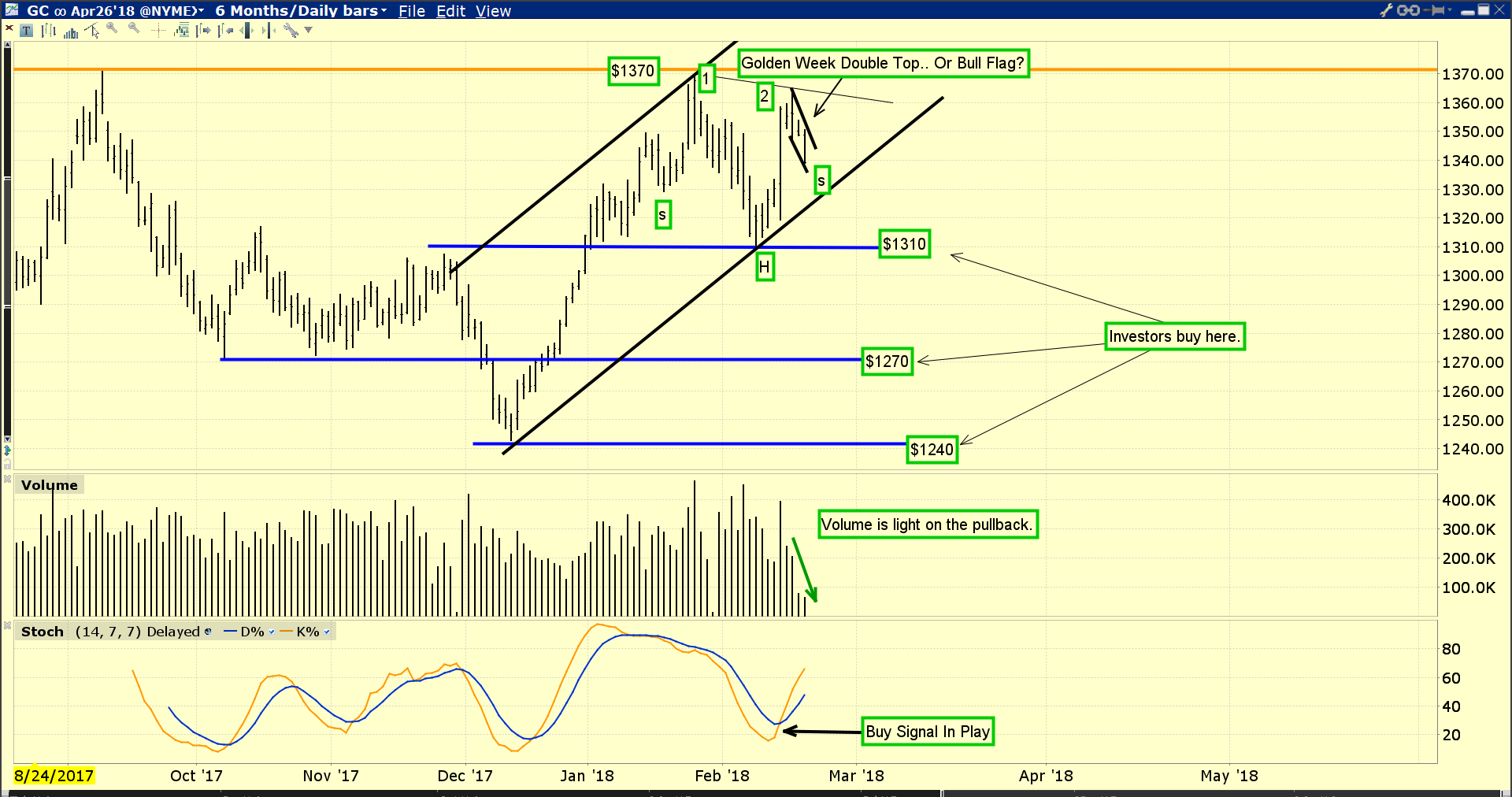

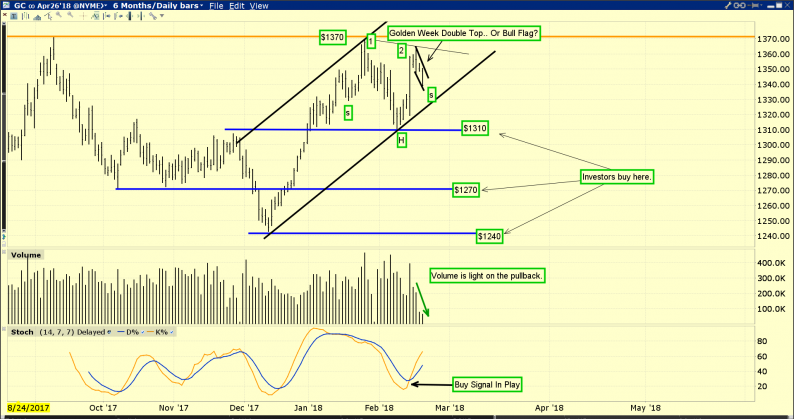

I’ve noted that when China’s markets go quiet during the “Golden Week” holiday, the gold price tends to soften.

Price softness is expected during this holiday, and the good news is that it is occurring on very light volume.

The bears would argue there’s a small double top in play, while the bulls have an inverse head and shoulders bottom pattern on their team. A bull flag pattern may also have formed.

I’ve told investors to expect a substantial battle between the bulls and bears in the $1370 area, and that’s exactly what is taking place.

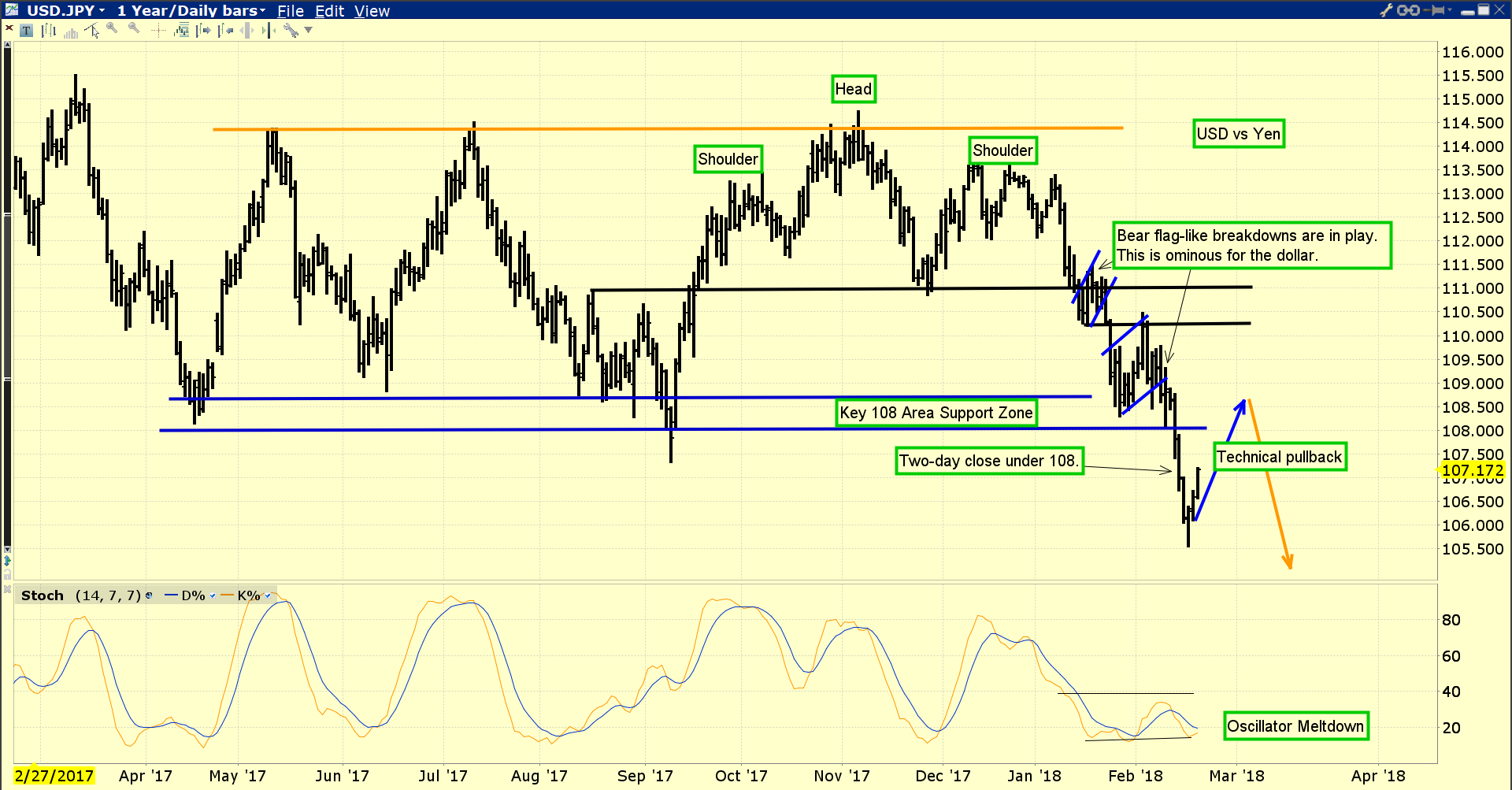

After tumbling through key support at 108, a relief rally is now in play.

The 108 area is now resistance. For gold, the price action of the dollar against the yen is very important. I expect the dollar’s relief rally to fail in the 108 – 110 area, and then a descent towards par (100) should get underway.

That would be a key signal that gold is going to move above $1370 and attract significant institutional interest by doing so.

In terms of trading volume, gold is a huge market. On a daily basis, dollar volume for gold trading in London is about as big as all the dollar volume for all the stocks traded on the New York Stock Exchange.

Banks trade gold as a FOREX market currency. In terms of volume, it’s the fifth most active in the world. So, when the gold price weakens as Chinese buyers go on holiday, that can affect other major markets.

For example, today the Dow is down, bonds are down, but the dollar is up against the yen. That’s because Golden Week is pushing gold down against the dollar and FOREX traders are reacting to that in the dollar-yen market.

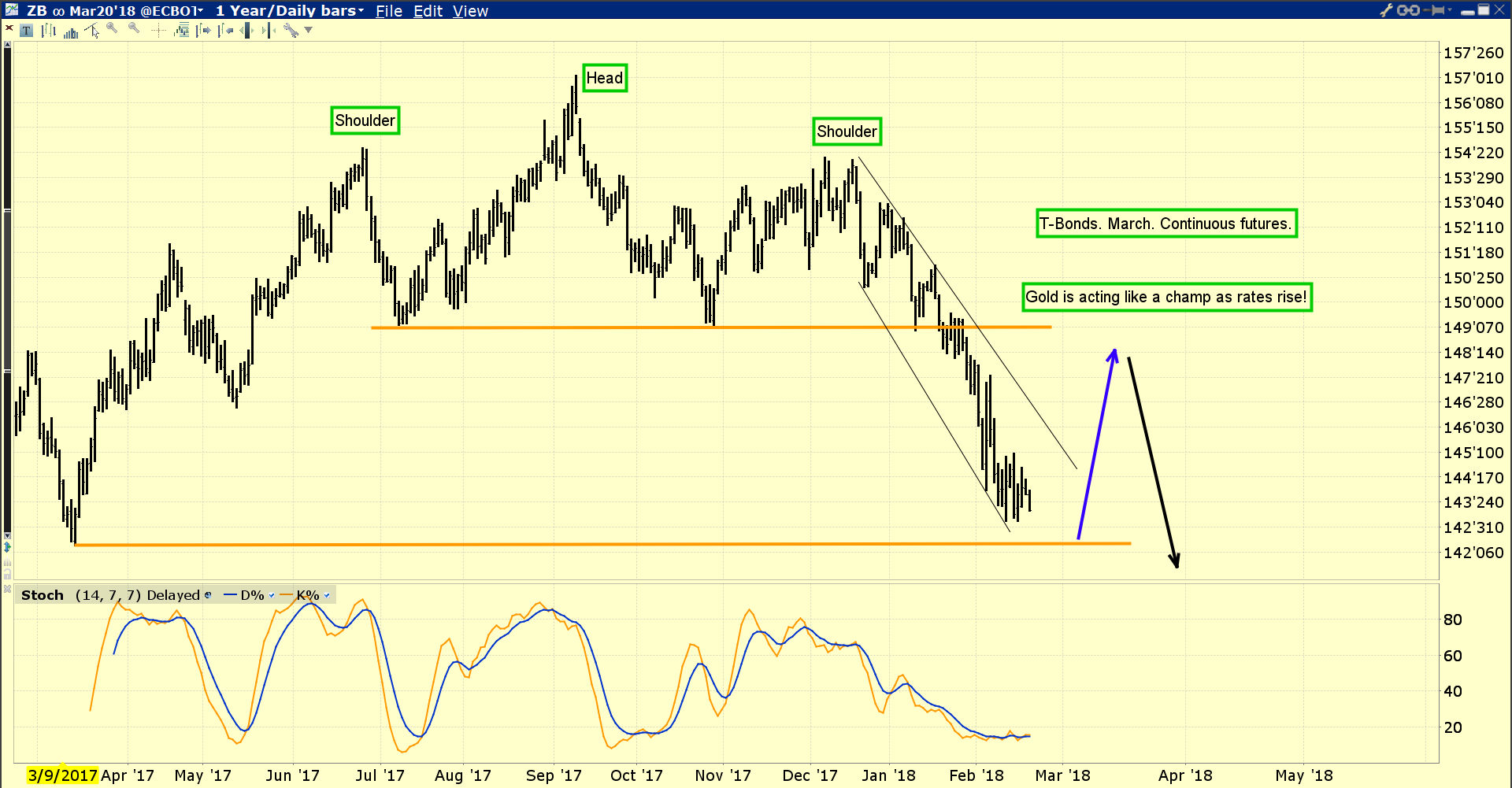

Most bank analysts thought that gold would fall if the Fed launched quantitative tightening and rate hikes. Instead, gold has rallied since the tightening cycle began, as I predicted it would.

Leave A Comment