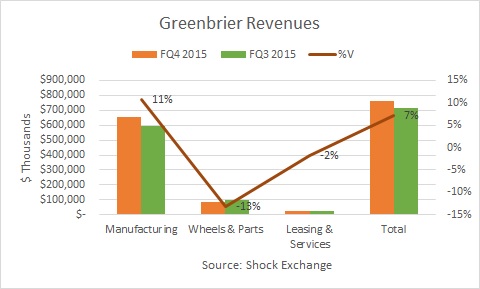

Greenbrier Companies GBX delivered fiscal Q4 earnings late last week. The company reported revenue of $766 million and eps of $2.02. Revenue was up 7% sequentially, but it missed analysts’ estimates by over $50 million. GBX has rallied 13% to over $40 since earnings were announced. I had the following takeaways on the quarter.

Manufacturing Firing On All Cylinders

The company’s Manufacturing segment (83% of total revenue) is firing on all cylinders. Manufacturing produces double-stack intermodal railcars, tank cars, conventional railcars, automotive railcars and marine vessels.

Revenue was up 11% sequentially, versus declines of 13% and 2% for Wheels & Parts and Leasing & Services, respectively. Part of Manufacturing’s success could be due to Greenbrier’s ability to diversify away from the troubled energy sector. While the company rescheduled production for certain energy-related customers, the move freed up space to fill orders for higher-growth segments such as intermodal and automotive. Since FY15 80% of new railcar orders have been for non-energy related applications.

$4.7B Backlog Is A Major Tailwind

Greenbrier has a diverse backlog of 41,300 units valued at $4.7 billion, at an average unit sales price of $114,000 per unit; the backlog is up 42% versus the $3.3 billion backlog in FY2014. For FY2016 the company expects delivery of approximately 20,000 to 22,500 units, and revenue of $2.8 billion (up 8% Y/Y). At the midpoint of its expected deliveries, 90% of those deliveries are in firm backlog or in lease railcars held for syndication already on the balance sheet. FY2016 is practically in the bag; any risks to Greenbrier missing top line numbers may have to come in FY2017 or beyond.

The fact that most of FY2016’s expected deliveries are already in the backlog is an indication of just how conservative forward estimates are. Management also went through pains to reference its lack of dependence on the troubled energy sector; Tank cars for sand or hydraulic fracking comprises only 30% of its current backlog, and tank cars for crude transportation make up less than 10%.

Leave A Comment