If you were following along last week, you know that more than a few commentators believe rates and the dollar have simply priced in too much pessimism around the U.S. economy and the fiscal outlook.

No, the incoming data hasn’t exactly been what one might call “gangbusters” and the prospects for tax reform and fiscal stimulus seem to dim every time Trump opens his Twitter app or decides to deviate from the teleprompter, but with yields near YTD lows, the dollar struggling to get any kind of traction, and positioning stretched, one could make a contrarian case based simply on the proposition that it would be difficult for the outlook to deteriorate much further from here.

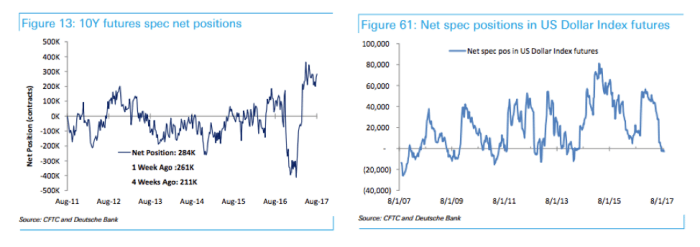

(Deutsche Bank, CFTC)

As a reminder, part of the reason why folks are so concerned has to do with the daunting tasks ahead for a Congress that has proven utterly incapable of getting anything done.

“Members of Congress return from summer recess Tuesday with the eyes of bond traders squarely upon them,” Bloomberg wrote on Friday, before reminding anyone who might not follow markets closely that the angst is readily apparent in the T-Bill curve:

Of course everyone you care to ask will tell you there’s no chance the debt ceiling won’t be raised and as Goldman and others have variously suggested, it’s likely that Hurricane Harvey will help matters along.

“GOP leaders are likely to pair the first installment of Harvey aid with legislation to raise the debt ceiling, easing its passage and then take up a stopgap government-spending measure later in the month,” WSJ notes.

“In a letter to House Speaker Paul Ryan requesting [nearly $8 billion] in storm aid, Budget Director Mick Mulvaney on Friday stopped short of explicitly asking for the aid to be tied to raising the debt ceiling,” Bloomberg goes on to write, in a separate piece out Saturday before adding that “the letter [does] make clear that the emergency spending will accelerate the timetable for raising the limit and conveys the idea that failure to pay obligations could imperil essential government services.”

Leave A Comment