Meat and food products company, Hormel Foods Corporation (HRL – Free Report), reported mixed first-quarter fiscal 2018 results (ended January 2018).

Earnings/Revenues

Adjusted earnings in the reported quarter came in at 56 cents per share, outpacing the Zacks Consensus Estimate as well as the year-ago tally of 44 cents per share.

Net sales in the fiscal first quarter came in at $2,331.3 million, missing the Zacks Consensus Estimate of $2,403 million. However, the top line came in 2.2% higher than the year-ago tally.

Segmental Break-Up

In the reported quarter, revenues from Grocery Products inched up 0.6% to $613.9 million.

Revenues at the Jennie-O Turkey Store segment dropped 7.2% to $390.6 million.

The company’s Refrigerated Foods segment generated revenues of $1,176.5 million, up 4.8% year over year.

International & Other revenues were up 19.5% to nearly $150.3 million.

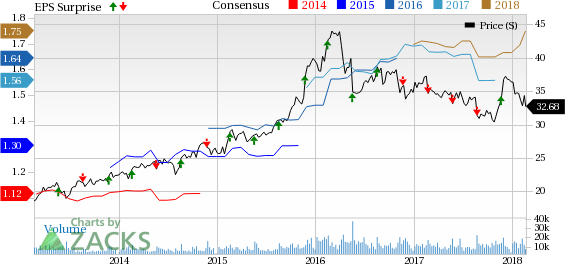

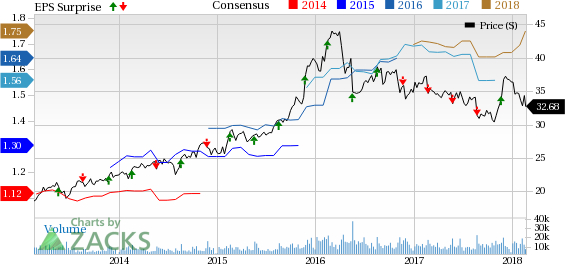

Hormel Foods Corporation Price, Consensus and EPS Surprise

Hormel Foods Corporation Price, Consensus and EPS Surprise | Hormel Foods Corporation Quote

Costs/Margins

In the fiscal first quarter, Hormel Foods’ cost of sales went up 5.9% year over year to $1,829.1 million. Gross margin contracted 270 basis points (bps) to 21.5%.

Selling, general and administrative expenses totaled $219.1 million, up from $210.2 million recorded in the comparable period last fiscal.

The company’s operating margin came in at 13.2%, shrinking 240 bps year over year.

Balance Sheet/Cash Flow

Exiting the fiscal first quarter, Hormel Foods had cash and cash equivalents of $385.8 million, up from $444.1 million as of Oct 29, 2017. However, the company’s long-term debt came in at $624.7 million (excluding current maturities), up from $250 million reported as of Oct 29, 2017.

In the first three months of fiscal 2018, Hormel Foods generated cash of $304.2 million from operating activities, significantly up 55.8% year over year. Capital expenditure on purchase of property and plant summed $52.9 million compared with $34 million incurred in the prior-year period.

Leave A Comment