This video segment discusses the $1 trillion+ deficit in corporate pension plans and how the average fund today is missing 20% of the capital needed to pay benefits promised. It is critical to note that this capital hole persists even at the end of the longest financially engineered rise in asset markets and corporate profits ever in history!

Here is a direct video link

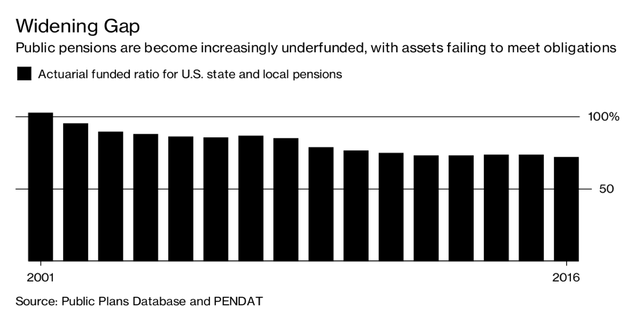

Publicly funded government pension deficits are worse, as shown in the table below, the average pension has gone from a capital surplus in 2001 to a 30% deficit by 2016.

In response to falling interest rates and yields, secular highs in asset valuations and capital risk, and increasingly unfavorable demographics, pension plans have responded by–you guessed it–increasing their risk exposure to further capital losses!

As shown in the next chart, the percentage of lowest risk, interest paying bonds, and cash fell from nearly 100% of public pension holdings in 1952 to just 25% by 2012 as double-or-nothing management styles have become the reckless, misguided norm worldwide.

Twenty years of levered risk-taking–subsidized by taxpayers, aided and abetted by central bankers and politicians–have helped push asset values back up to all-time highs, and still, savings deficits have deepened. That’s because the current system is not designed to balance and sustain retirement payouts, but rather to allow financial intermediaries, some politicians, and corporate executives to extract the most for themselves above all else.

The way out of savings deficits is not more magical financial gimmicks, but rather the old-fashioned, tried and true method of contributing more, taking less capital risk with the funds, and at this point, paying out later and lower benefits until balances recover to fully funded status once more.

As I explained here in Wishful Thinking and Willful Blindness Yield Pension Plan Disappointment, even the relatively well managed Ontario Municipal Employee Retirement Security (OMERS) has recently admitted how the plan must remedy its funding deficit, as laid out on their website:

Leave A Comment