IBM trades at a forward earnings multiple of 9x and has a dividend yield approaching 4%. The stock is either really cheap, or the market is sniffing out more trouble ahead with management’s current strategy. We aren’t ready to jump in just yet and keep the stock out of our Top 20 Dividend Stocks portfolio for now.

However, Warren Buffett sees value and added to his position during the third quarter as IBM reported another disappointing set of results. IBM’s third quarter revenue declined for the 14th straight quarter and came in below all 17 analysts’ estimates.

While there is plenty of talk about how the move to off-premise cloud computing is hurting many of IBM’s “old technology” businesses today, IBM’s current struggles have been developing for years. The company’s sales fell 5% in 2013, 7% in 2014, and are expected to drop over 10% in 2015, including divestitures. A smaller decline is expected in 2016, but it remains to be seen if management can finally stop the bleeding.

Despite stagnant revenue (sales were $91.1 billion in 2005 compared to $$92.8 billion in 2014), IBM’s management team has obsessed over meeting expectations for earnings growth, trading off long term business prosperity for near term earnings “beats.”

The company has repurchased about 40% of its shares since 2005 and implemented numerous cost reduction efforts, including substantial layoffs in recent years, to grow earnings. For a while, these actions looked to be working. Diluted earnings per share nearly tripled from 2005 through 2013 and operating margins doubled to hit 20%. Even IBM’s stock was a winner, significantly outpacing the S&P 500 from 2005 through 2011.

However, IBM’s cutting finally caught up with it in several ways. In the technology sector, innovation is everything. Innovation thrives in a culture that rewards experimentation and new ideas, not layoffs and strict adherence to quarterly EPS targets.

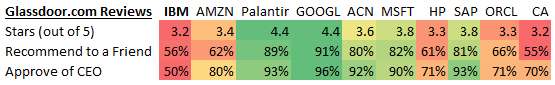

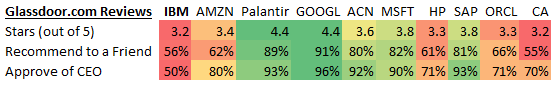

Gauging innovation and company culture is difficult, but a website called Glassdoor.com aggregates employee reviews for thousands of companies. As seen below, IBM ranks last in overall stars, the percentage of employees who would recommend the company to a friend, and the percentage of employees who approve of the CEO.

Source: Glassdoor

This speaks to the internal turmoil that chronic layoffs and cost cutting have had on IBM’s culture. If you were an up-and-coming software engineer, why would you want to work for IBM? The company lacks the vision and inspiration of an Amazon (AMZN) or a Google (GOOG).

Leave A Comment